Exactly one week after Goldman became the first major bank to raise its 10Y yield target from 3.00% to 3.25%, this morning BofA was delighted to follow in Goldman’s footsteps and also revised its 10Y year-end forecast to 3.25%, given “above-potential growth and worsening supply/demand dynamic,” the bank’s rates strategist Mark Cabana wrote.

Here are BofA’s highlights:

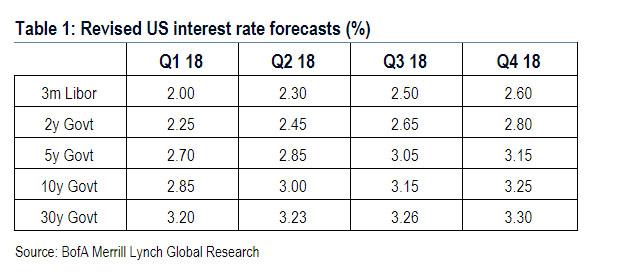

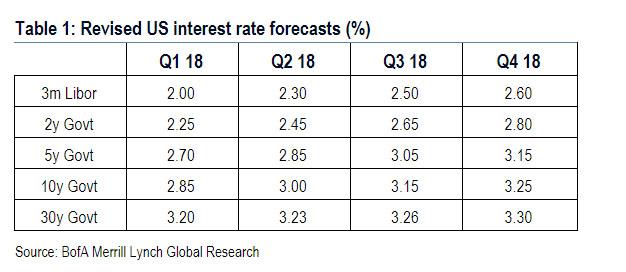

BofA’s rate forecast consists of two parts: one for the first quarter, where the bank expects 2.85% to hold, and then for year end, which it now sees as rising to 3.25%.

Coming into this year, we had an out of consensus US 10y rate forecast of 2.85% for end 1Q18. Our thesis was that rates were set to rise as a result of improved growth and inflation via tax reform as well as a worsening supply picture. The market has caught up with our view and we continue to believe rates can reprice higher. We adjust our forecasts to remain above consensus and forwards.

We now expect the 10Y rate to reach 3.25% by the end of the year driven by above-potential growth and a worsening supply / demand dynamic. However, this transition will likely be a bumpy one due to the interplay between rates and risk assets. We continue to believe the 30Y part of the curve will be well supported as a result of ongoing pension-related demand.

Looking at the recent rip higher in yields, BofA believes that “rates in the US can continue to reprice higher and adjust our forecasts to remain above consensus and forwards (Table 1, Chart 1)” as a result of “the combination of solid growth, normalizing inflation, and higher deficits / Fed portfolio reduction should see yields rise further.”

The highlights from the bank’s revisions:

Leave A Comment