The Bank of Japan maintained its monetary stimulus on Friday at Governor Haruhiko Kuroda’s last policy meeting before possible reappointment.

The central bank kept its asset purchase program unchanged, citing weak inflation rate and external risks, while at the same time stating that the bank is not thinking of adjusting its monetary policy until 2 percent inflation target is achieved.

This was after the govern said last week that the apex bank will likely be thinking of balance sheet normalization next year. Meaning, the rising Yen and growing external risks despite the strong economic fundamentals are likely to hurt Japanese economic outlook, especially the low consumer prices and strong foreign exchange.

“We’re not thinking at all about weakening the degree of easing, or changing the current monetary easing policy framework, before we achieve 2 percent,” Kuroda said on Friday during a news conference.

Again, strong exports have aided Japan’s economic recovery in the last two years, therefore, rising Japanese Yen may start hurting exports even though rebound in the commodity market is projected to bolster global economy in 2018.

The world’s third-largest economy has now expanded for eight consecutive quarters with unemployment rate improving to 2.4 percent, the lowest in 25 years. Yet, inflation rate and wage growth remained subdued.

“But developments on trade policies can have a major impact on the global economy and international financial markets beyond the nations involved,” Kuroda said. “I’d like to keep watching them carefully.”

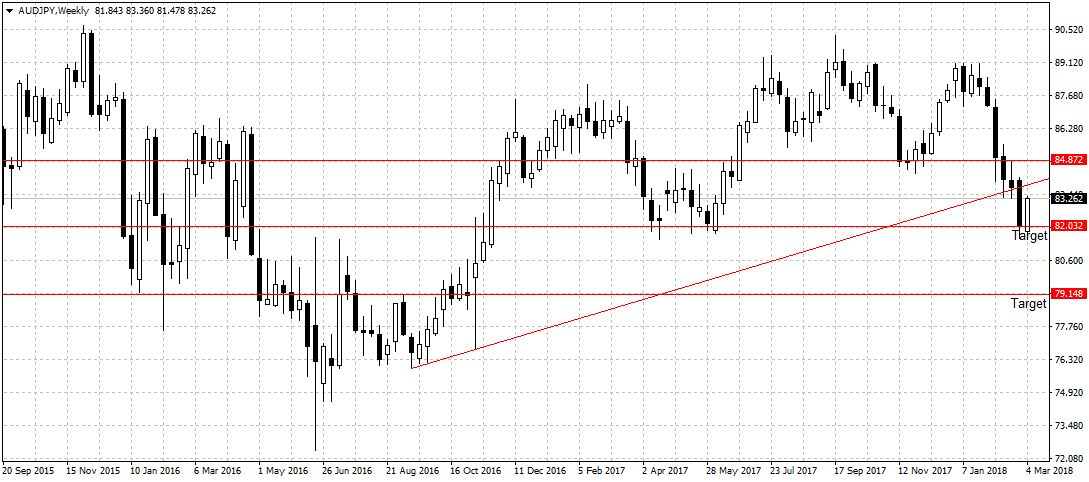

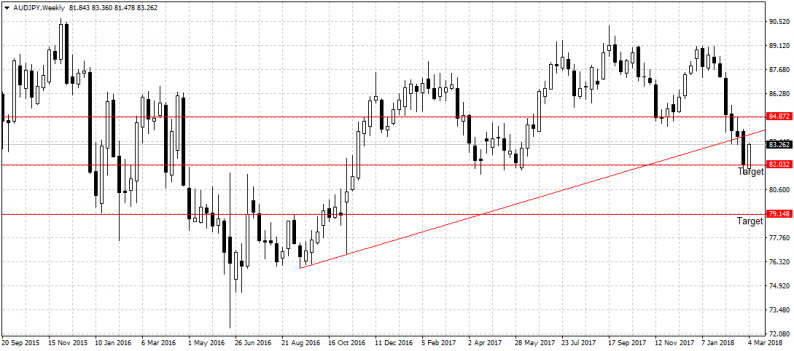

The Yen dipped across the board, losing 0.71 percent against the Australian dollar to 83.28. However, still below the ascending channel as shown below.

Experts expect Haruhiko Kuroda to be reappointed as the Bank of Japan’s Governor next month.

Leave A Comment