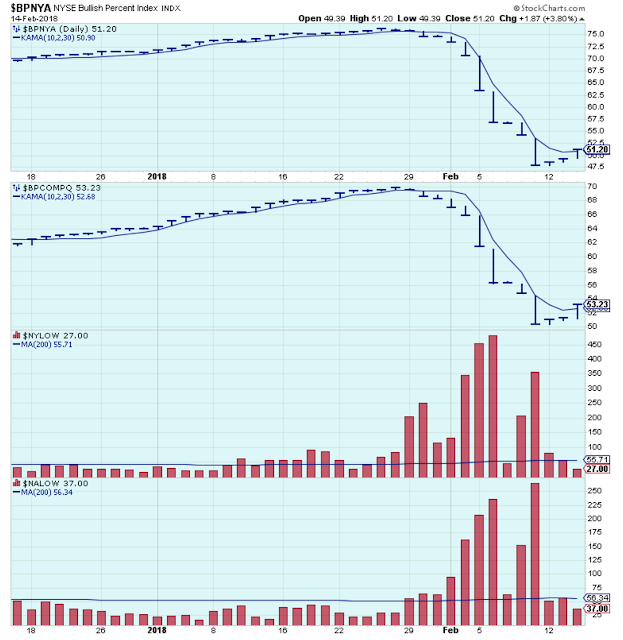

The market internals look a lot better. The bullish percents are headed higher, and the number of new 52-week lows has settled down.

The Nasdaq is now above its 50-day, but the other major indexes are still below. I am still thinking that the market needs to retest the lows of its recent trading range before a sustained uptrend begins again. The only problem is that everyone else is saying the same thing.

I haven’t had time today to listen or read very much about this morning’s inflation numbers other than the headlines, but I can tell from this chart below that the reaction to the news is that rates are headed higher. Regional Banks are rate-sensitive, and this index looks like it wants to break into new highs soon.

Bond funds are breaking down (rates higher, bond prices lower).

Here is one thing that I am trying to keep in mind. Rates have made a big move since the summer. Sometimes that is a set up for an unexpected counter-trend rally. Just saying.

Outlook Summary:

Higher rates are now a headwind for US stocks. The recent tax cut, the 300 billion spending increase, and the already out-of-control federal deficit are a set up for a very dangerous spike in interest rates.

The long-term outlook is cautious.

The medium-term trend is down.

The short-term trend is down. Watching for the next short-term uptrend.

Leave A Comment