European bonds are collapsing… systemic risk is rising… US Services economy “pillar” plunges… and jobs data is dismal – stocks shrugged…

The USD Index is down over 3% this week – the worst 4-day drop since China’s devaluation in August and plunging it back to 4-month lows…

Perhaps this is why? PBOC is actively intervening – selling USDs to support offshore Yuan…

Trannies were ecstatic… but the rest of the US equity market just could not get with the program…

VIX spikes broke the market and sparked rallies…

US Financial credit risk broke out to its highest since 2013…

Things are getting a little bit scary…

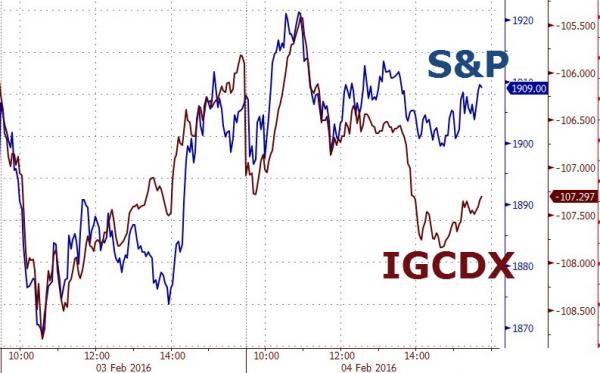

Investment Grade credit is starting to decouple from stocks…

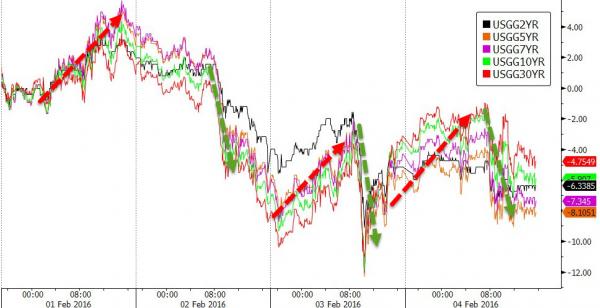

Treaury yields fell once again (led by 5s to 10s) as we saw overnight selling (PBOC intervention) dominated by US session buying… 30Y below 2.70%

The Dollar was weaker today… with JPY now 3.5% stronger on the week as carry gets unwound…

Sold against all the majors…

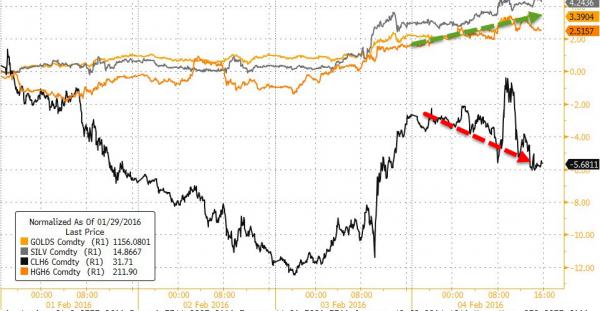

Gold and Silver extended their gains…

Copper’s gains sparked chaotic panic buying in Materials stocks…

As crude roller-coastered…

Charts: Bloomberg

Leave A Comment