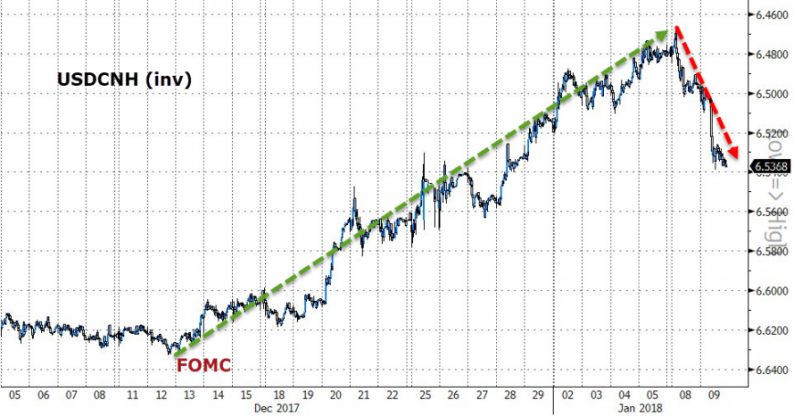

First things first – Japan tapered its bond purchases once again (and sparked chaos in bond land) and China shifted its FX regime, sparking a tumble in the Yuan…

Both seemingly sending a clear message to bond bulls..

6 days into 2018 – 6 days up for the S&P 500 and 6 days with 10Y above 2.4% – and the 3% YTD gain for the S&P (orange) is the best start to a year since 1987 (Nasdaq is up 4.5% YTD, and Small Caps are lagging up just 1.8% YTD)

Today saw a weak close for the first time in 2018 which dragged Small Caps into the red, and Nasdaq red briefly before the close… Dow outperformed with Boeing dominating (65pts)…

VIX ruined the party – having closed below 10 for the last 5 days in 2018, it closed above 10 today…

While AMZN hit a new record high today (confirming Jeff Bezos as being worth more than what Bill Gates was at his peak), FANG stocks actually closed lower, breaking the 2018 win streak as NFLX weighed the index down…

Kodak soared 130% today after mentioning something to do with Blockchain…

HY Bonds tumbled notably, back below their 50- and 100-DMA (after a massive ramp)…

Bonds were an utter bloodbath with the long-end getting crushed today..

30Y yields hit the highest since 11/1/17, but 10Y Yield broke (and closed) above 2.50% for the first time since March 2017…

The Treasury curve steepened most today since the Nov 2016 election of Donald Trump… and while that sounds very exciting, it merely moves the curve back to its steepest since Boxing Day…

The Dollar Index rallied again today, touched unchanged for 2018 then faded…

Leave A Comment