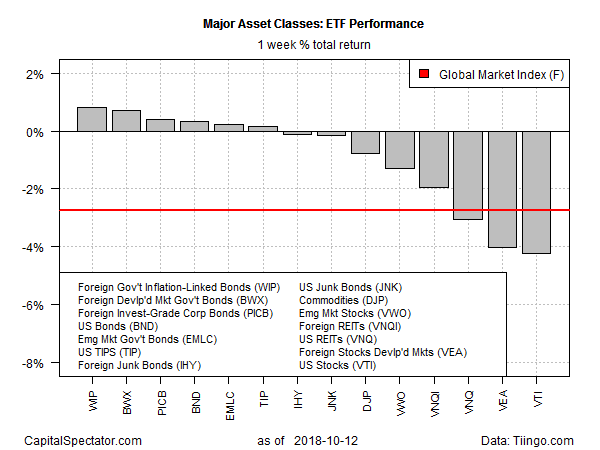

Foreign bonds posted the strongest gain for the major asset classes last week, delivering a contrast with falling prices in equity markets around the world, based on a set of exchange-traded products at the close of trading on Friday, Oct. 12.

Inflation-linked government bonds in foreign markets led the field. SPDR Citi International Government Inflation-Protected Bond (WIP) edged up 0.8% last week, although the ETF remains close to its lowest close in more than a year.

Foreign and US bonds overall dominated the winner’s list for last week’s trading. US investment-trade fixed-income securities, for instance, gained 0.3% via Vanguard Total Bond Market (BND).

US equities, by contrast, suffered the most last week. Vanguard Total Stock Market (VTI) tumbled 4.2%, the ETF’s biggest weekly decline since March.

The weakness in equities generally last week weighed on an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights fell for a third week, sliding 2.7% — the index’s deepest weekly loss in seven months.

For the one-year trend, only three slices of the major asset classes are holding on to gains, led by US stocks. VTI is up 9.7% for the trailing 12-month total return. Broadly defined commodities (DJP) and US junk bonds (JNK) are also posting positive comparisons for one-year results, albeit well below the gain for US equities.

Otherwise, the rest of the major asset classes are in the red for the year-over-year comparison. The deepest one-year setback is currently held by stocks in emerging markets. After last week’s decline, Vanguard FTSE Emerging Markets (VWO) is nursing an 11.4% slide.

GMI.F, however, is still holding on to a modest gain: the benchmark up 1.8% on a total-return basis for the trailing one-year performance through last Friday.

For current drawdown, broadly defined commodities continue to suffer the biggest slide from the previous peak. The iPath Bloomberg Commodity (DJP) is currently posting a peak-to-trough decline of nearly 47%. US junk bonds, by comparison, are still posting the smallest drawdown – a bit more than 1%, based on SPDR Bloomberg Barclays High Yield Bond (JNK).

Leave A Comment