Why are bond yields falling again? There are, as always, a few reasons mostly related to perceived risks (with liquidity always right at the top, at least since August 2007). Those were more easily set aside, or at least more gently reconsidered, when inflation hysteria raged across the internet. But after talking about it for months, at some point it either shows up or bonds go back to sorting risk priorities again.

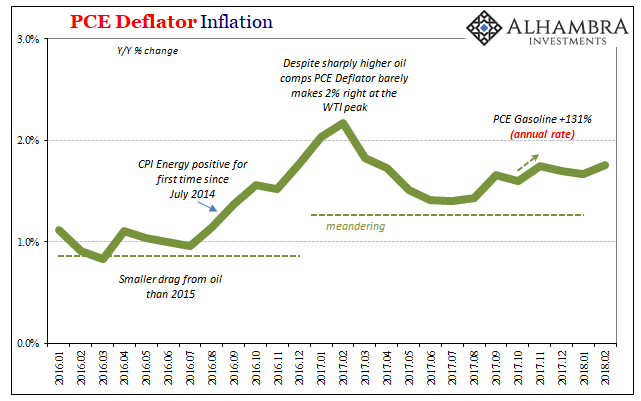

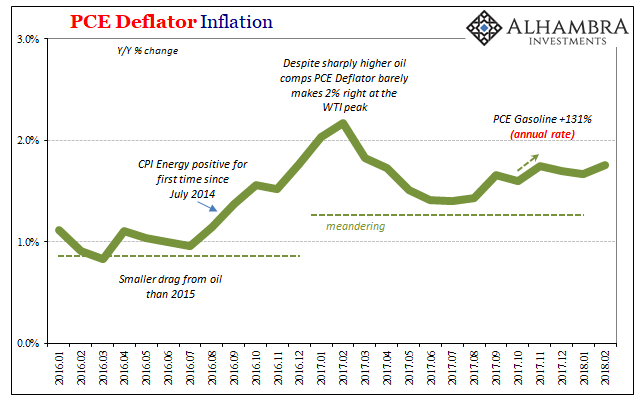

Another month in, and there is no acceleration for consumer prices indicated anywhere. Inflation rates, whatever you may make of calculated indices, continue to display a distinct lack of get-go. In addition to confirming another year of amped up residual seasonality, on the strength of distinct persistent weakness in labor incomes, no less, the BEA also reports today that the PCE Deflator “transitorily” undershot its official policy target for the 68th time out of the last 70 months.

More immediately, after registering 2% just twice last year (the second on a benchmark revision), the PCE Deflator has begun a new streak of misbehaving that has stretched to a full year all over again (and counting). The current index places consumer price inflation at 1.75%, not appreciably different than any other calculation over those twelve months.

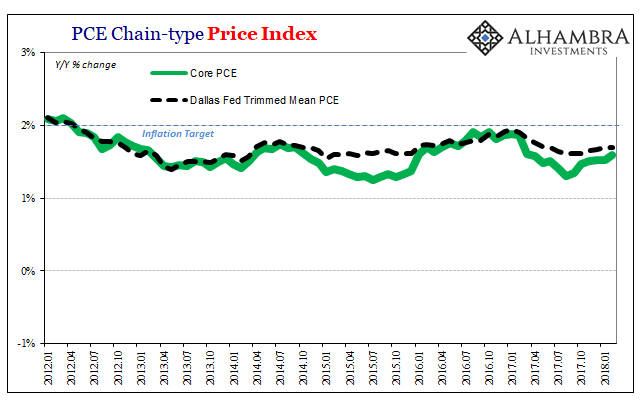

At the same time, so-called core rates (the index that strips out food and energy, as well as the Dallas Fed’s stunted number that precludes outlier basket items at both the top and bottom) display no conspicuous tendencies that would make one believe this will change anytime soon. An economy moving toward overheating already having been at, supposedly, full employment for as many as three years would not be so tenacious about its unurgency.

As noted recently in discussion of other inflation rates in the US, the monetary policy and overall price environment of the current period match up quite familiarly with the terminal stage of the dot-com era. Only then, unlike now, consumer prices were far more energetic particularly at the point where the Greenspan Fed felt compelled to step in.

Leave A Comment