For the past 5 years, Brazilian stocks have been hammered. Since the top in 2011, equities in Brazil have experienced a 74% drop. But that appears to be changing. You wouldn’t think that if you used the financial media to make your investment decisions. You would think that the worst is yet to come. For example, take a look at this headline that posted just a few hours ago.

If you followed our research before, you know we’re not big fans of financial media. It’s not that we have anything against reporters. After all, they have a job to do. But at 360 Investment Research, we don’t use financial headlines to invest. It’s noise. We use price.

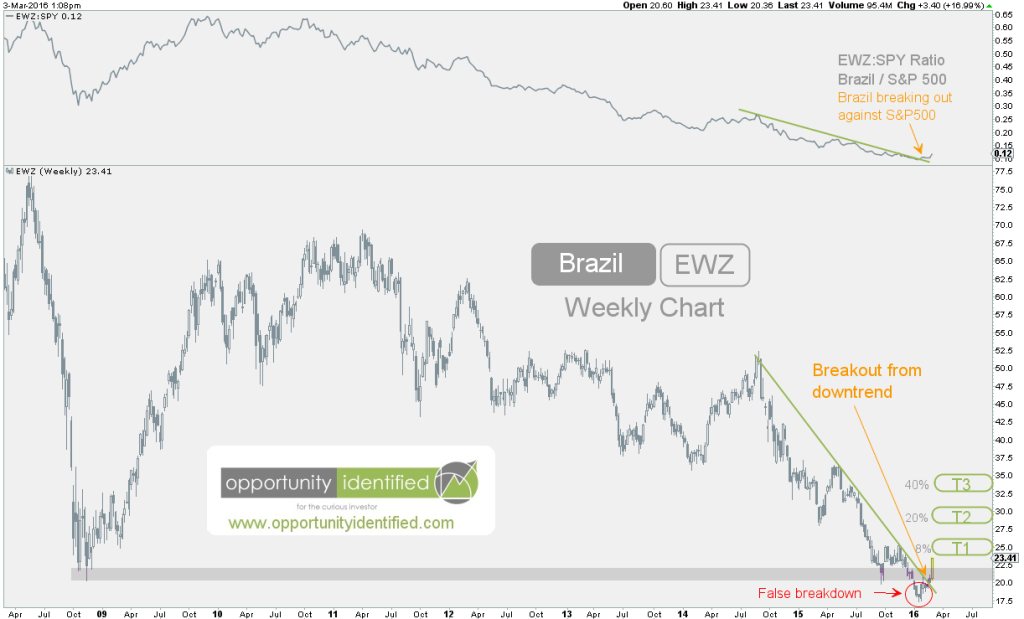

Let’s take a look at what’s really happening in Brazilian stocks. Below, is a weekly chart of the Brazilian ETF EWZ. It dates back to 2008 and shows the bottom put in late that year during the Great Financial Crisis (GFC). In addition, we can see the significant drop in Brazilian stocks dating back to 2011. We also notice a significant development – price has recently broken out from an 18-month downtrend. Just as significant, we can see that price originally broke below the late 2008 lows, but quickly reversed back up over that level. This is known as a false breakdown. And from false moves come fast moves in the opposite direction.

Taking a closer look, using a daily chart, we can see just how clean this breakout is.

We are a fan of this setup. Our risk is well defined while the upside reward is definitely significant. We can see previous areas of supply that mark our targets for exiting any trade long. These levels represent anywhere from an 8% to 40% return. Obviously, nothing is guaranteed and we don’t marry our opinions. If EWZ drops below 21.00, we’re no longer interested. Price knows more than we do. Price knows more than the financial media.

Leave A Comment