Photo Credit: jessicalsmyers

Tiffany & Co. (TIF) Consumer Discretionary – Specialty Retail | Reports March 18, Before Market Opens

Key Takeaways

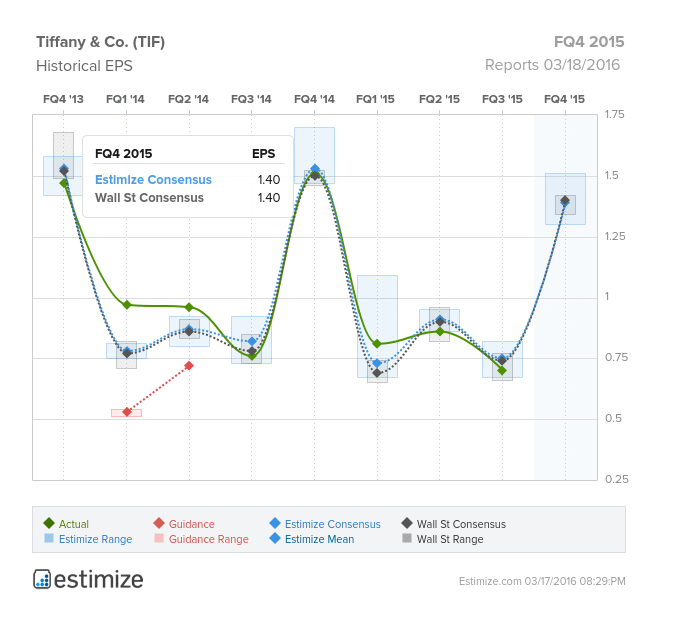

Despite being a girl’s best friend, diamonds and jewelry have lost their sparkle lately. In the past few years demand for jewelry related products have substantially declined. Unsurprisingly, Tiffany & Co’s earnings have suffered as a result, leading to misses on the top and bottom line in each of its last 2 quarters. Early indications suggest the company’s fourth quarter earnings won’t do much to reverse this pattern. In fact, Tiffany’s has seen a good deal of unfavorable revisions activity lately, with EPS and sales estimates down 10% each in the last 3 months. As a result, The Estimize community is looking for EPS of $1.40 on $1.21 billion in revenue, right in line with the Street on the top and bottom line. Compared to the year prior this predicts as a 7% decline in profitability while revenue is expected to shrink by 6%. Poor earnings have cost shareholders, with the stock falling 19.6% in the last 12 months. Overall weaker spending trends in the U.S. on top of macroeconomic volatility and the reluctance to offer promotions doesn’t bode well for the jewelry retailer moving forward.

Just ahead of their fourth quarter earnings, Tiffany & Co indicated sales fell 6% and comp sales fell 7% thanks to a weaker than expected holiday season. In an effort to reconcile its losses, the company announced its intention to cut jobs as it struggles to revitalize growth. The biggest obstacles have been slowing economic growth in China, currency headwinds and an overall weaker spending environment. Tiffany’s traditional reluctance to discounting or promotions has helped its cause either. In a bid to expand its offering and stimulate growth, Tiffany has been investing heavily into designing and marketing gold and silver products that appeals to younger consumers. Fortunately, Tiffany holds a significant position in the global jewelry market which could weather a negative surprise this Friday.

Leave A Comment