My Swing Trading Approach

I reduced my long exposure some on Friday, but still maintain 30% long and 70% cash. So if the market gap higher this morning can hold up, I’ll look to add more to the long side.

Indicators

Industries to Watch Today

Utilities led the way, followed by Energy and Real Estate. Financials had the biggest hit, and suddenly looks very problematic following the first batch of earnings released on Friday.

My Market Sentiment

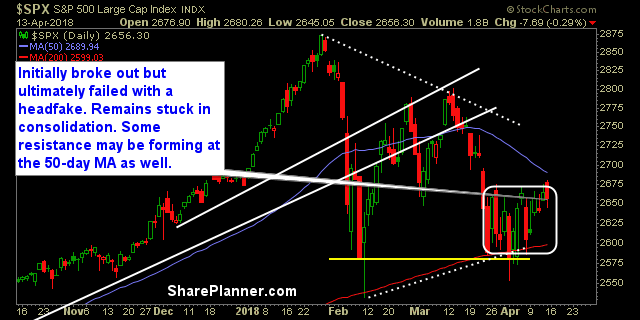

Friday started off well for the bulls, but the lack of follow through and ultimately the head fake that ensued, continues to frustrate traders. Breaking out of the box will continue to be key for traders moving forward and establishing a firm direction for the market.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment