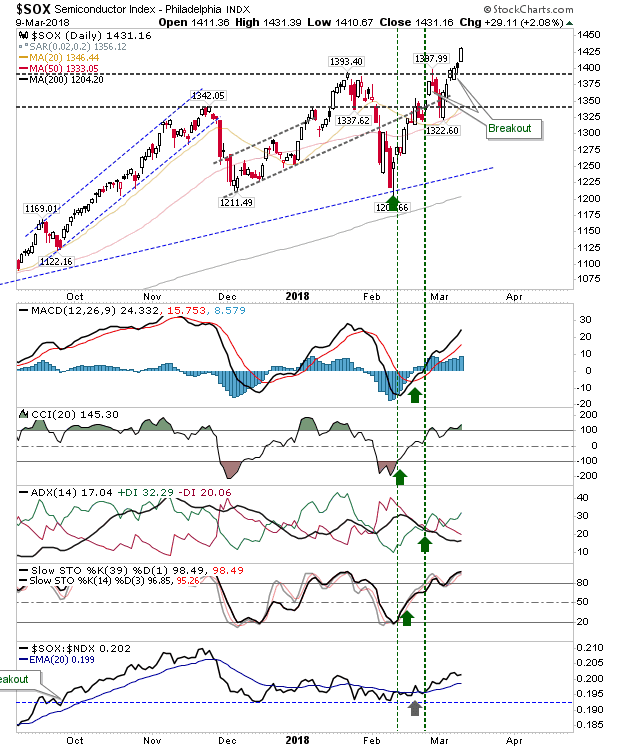

Leading indices again continued in their leadership roles; the Russell 2000 managed a new swing high with breakouts for the Nasdaq and Nasdaq 100 after Semiconductors closed at new all-time highs.

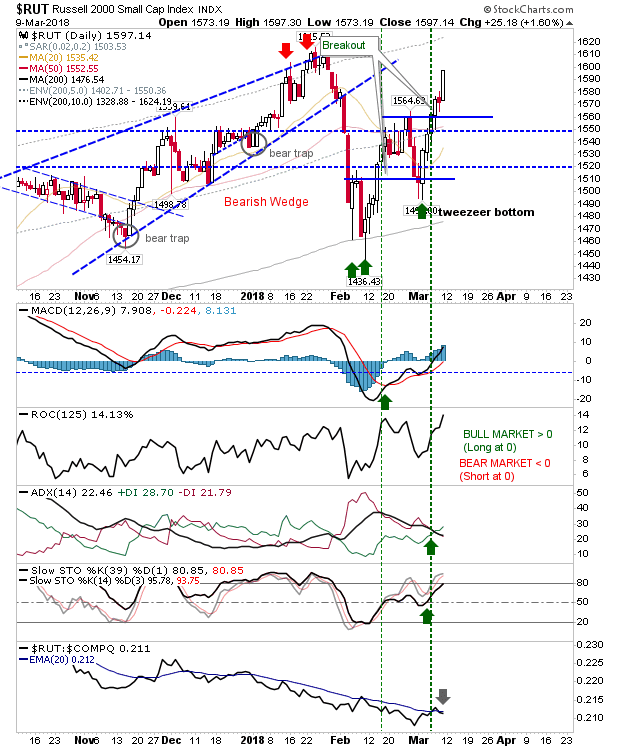

The Russell 2000 cleared 1,564 with relative ease with upticks in lead technicals – only relative performance suffered a small loss. Friday’s 1.6% gain now opens up for a challenge on all-time highs of 1,615. Even if markets were to sell off it would take a few days to reverse the bullishness generated by the rally from the ‘tweezer’ bottom.

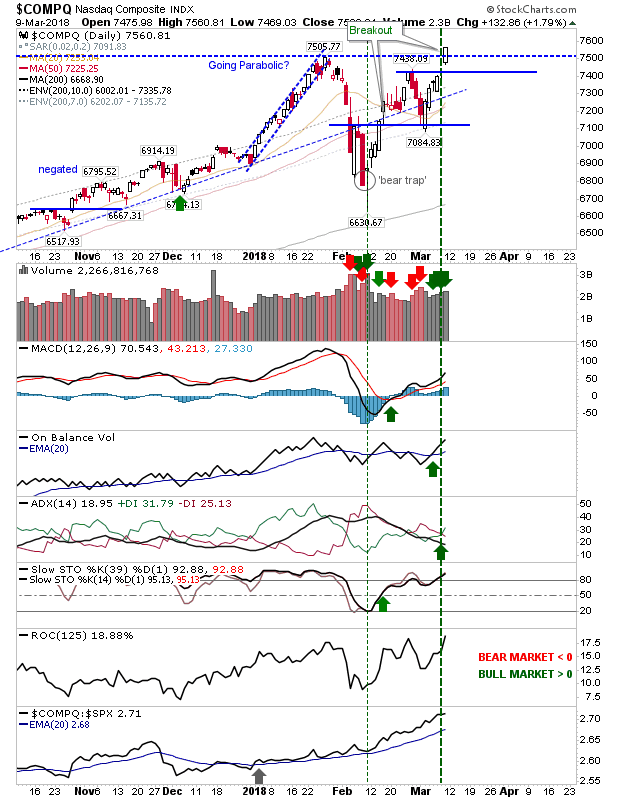

The Nasdaq posted a clear gap breakout on higher volume accumulation. Technicals are all net bullish. This index is following the lead of the Semiconductor Index with a solid breakout of its own.

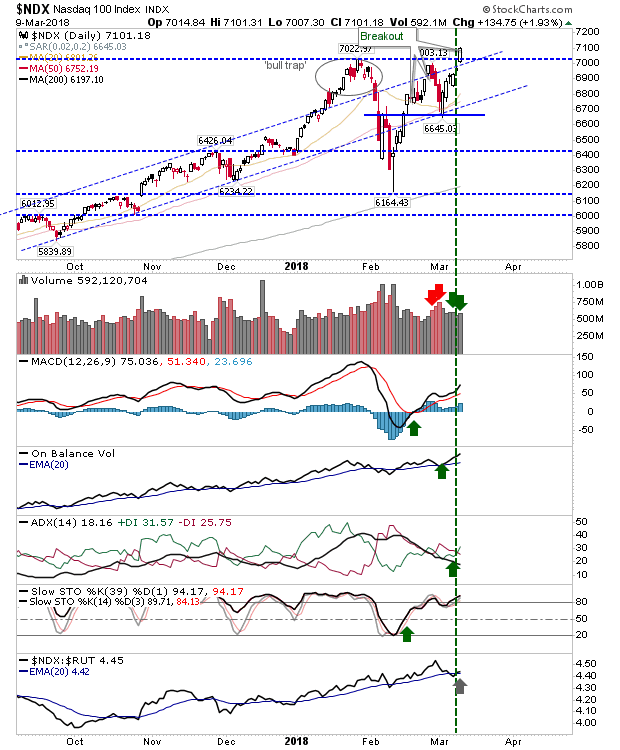

The same could be said for the Nasdaq 100 which managed to negate the big January ‘bull trap’. Volume rose in confirmation accumulation.

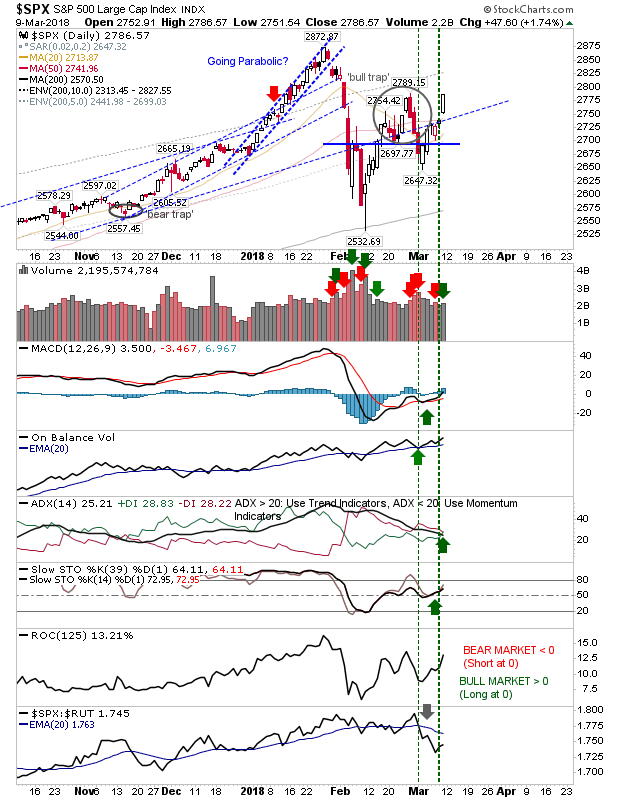

The potential short play offered by the test of former channel support and 20-day MA tag was swiftly undone right from the open. Bulls didn’t look back with the index closing at new highs for the day and edging a break of the February swing high based on an end-of-day close.

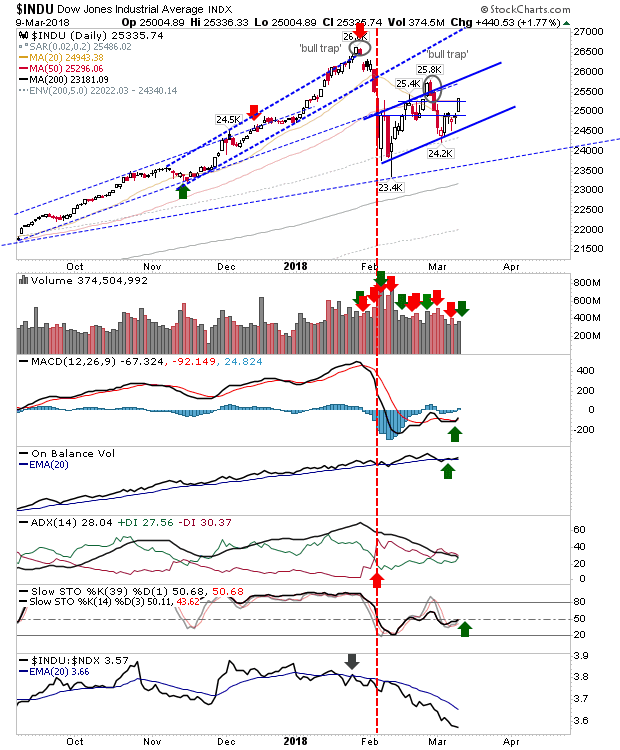

The weakest index, the Dow Jones Industrial Average, also had its short negated. However, there is still some way to negate the February ‘bull trap’ which other indices have already moved past. Relative performance continues to fall off a cliff which suggests if this rally was to crack then the Dow Jones Industrial average would be the first to suffer the consequences. Shorts may have been stopped out here but another opportunity could offer itself soon.

The index with the upside momentum is the Semiconductors Index. All technicals and relative performance are in strong alignment (higher) and have yet to suggest any potential weakness; e.g. a bearish divergence.

Given market strength, look to the Semiconductor Index to continue its run of good form and bring the Nasdaq and Nasdaq 100 with it. Should markets open weaker, then look to the Dow Jones to reverse the gains it made on Friday.

Leave A Comment