Brent Oil Price Increase Drives Inflation Expectations

The worst sectors were real estate and consumer staples as they fell 1.89% and 1.5%. The best ones were energy and tech which increased 1.47% and 0.31%.

As you can tell, oil prices and interest rates affected stocks on Monday. Brent oil peaked at $81.39 which was its highest level since November 21st, 2014. This was the beginning of the oil price collapse.

It closed at $81.2 which was a 3.2% increase. WTI oil increased 1.8% to $72.8 which was its highest close since July 10th. This oil price spike was catalyzed by OPEC leaders signaling they won’t immediately boost output. The supply glut is long gone.

The U.S. sanctions on Iran will eliminate 500,000 to 1 million barrels per day of the 2.1 million barrels per day Iran produces. An oil spike will increase interest rates and inflation which is bad for real consumption growth.

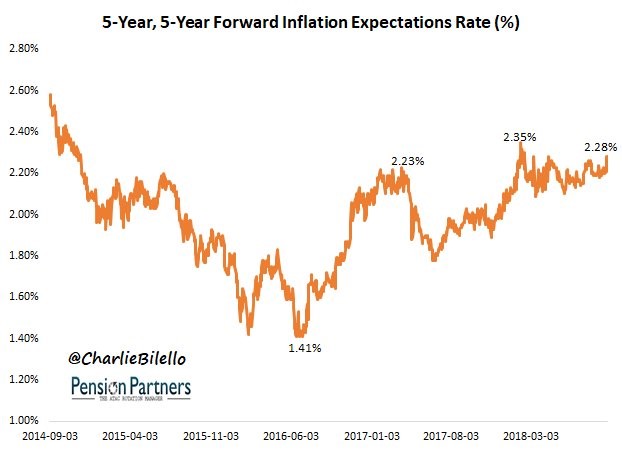

As you can see from the chart below, the 5 year forward inflation expectations rate has increased to 2.28% which is near the highest rate since 2014.

We’re nowhere near the set up in 2007 and 2008 where oil prices spiked and housing tanked. However, this is a new negative which can keep a lid on future equity gains this year.

Brent Oil – Treasury Yields Increase

With oil prices causing inflation expectations to increase, it’s no surprise that treasury yields also spiked on Monday. This explains why real estate was the worst sector.

The 2 year yield increased 2 basis points to 2.82%, which is another new cycle high. The 2 year yield started the year at 1.88% which means it’s up almost a full percentage point this year.

It is a lock that the Fed will raise rates Wednesday as the chances are 100%. There’s even a 6.2% chance rates are hiked twice. The chance of at least 2 more hikes this year are the highest yet as the odds are now at 82.8%. There’s even an 8% chance for 3 more hikes this year.

It’s interesting to see how the fear of rates being too close to the zero bound before the next recession has completely evaporated.It seems the Fed funds rate could get above 3% by the end of this hike cycle.

Leave A Comment