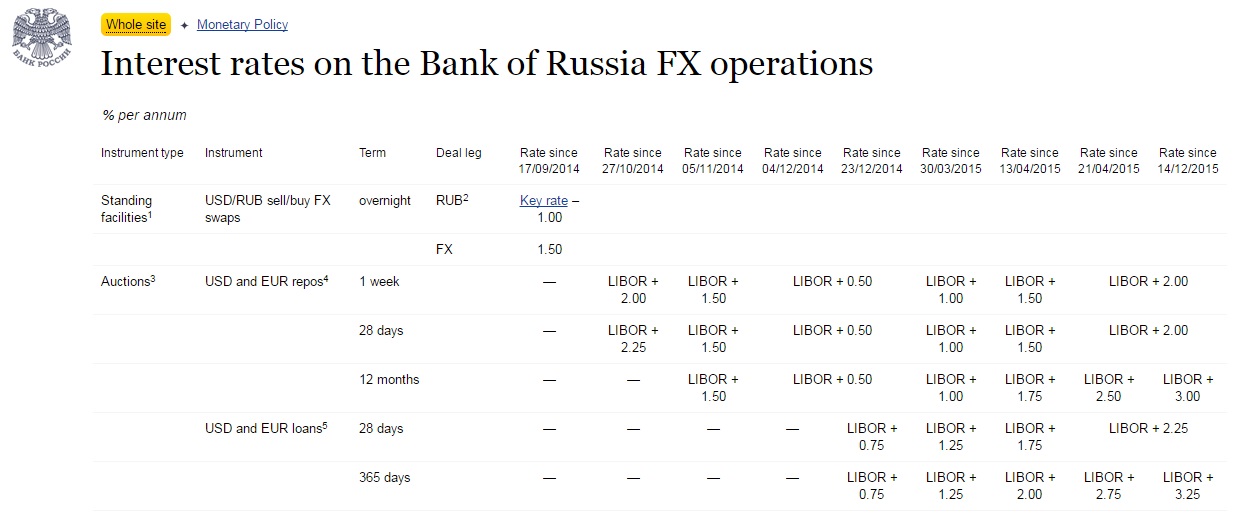

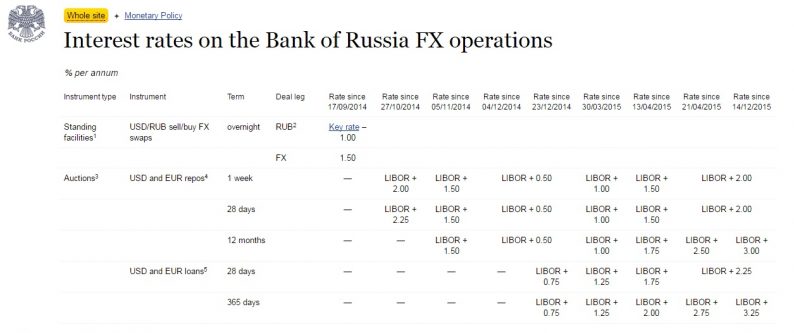

In late 2014, the Bank of Russia began to repo out eurodollars to local Russian banks. These financial institutions were being increasingly deprived of “dollar” funding on global markets. It made sense that Russia’s central bank would step in on their behalf, redistributing what it could out of its own pocket (though exactly which one was never made clear) to avoid a worst case scenario. Still, it got pretty bad for Russia anyway.

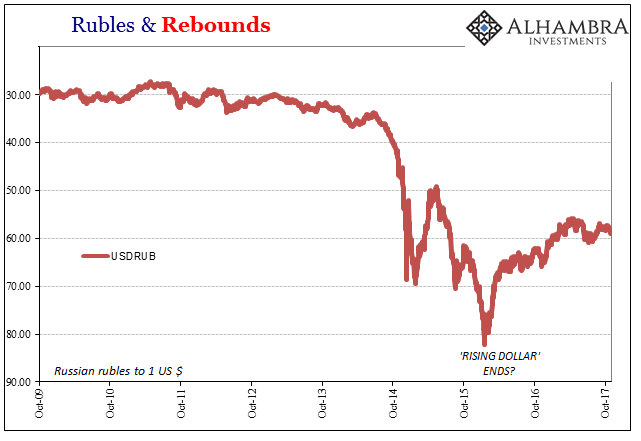

The ruble crisis that erupted at the end of 2014 was intense, offering Russian officials several shaky weeks where they didn’t how, exactly, they might stumble their way through it. On December 11 of that year, the benchmark money “key rate” was raised from 9.5% to 10.5% to address the rubles plunge. A mere four days later, the Bank of Russian raised it to 17%. It didn’t really do all that much, unsurprisingly, the currency’s plunge keeping up for more than a year after.

But that’s all in the past now. Russia’s brush with the “rising dollar” caused a lot of economic damage there just as it had elsewhere around the EM’s, but the ruble registered its lowest point on January 21, 2016, and has been rebounding since. Their monetary problems are over, right?

Maybe not. The ruble has only made its way back to 55 to the dollar, well short of the exchange rate of 30 prevailing before the eventful summer of 2013. Worse than that, it has been moving lower again going all the way back to April 2017, seven months of a gentle if unmistakable slump that raises several issues.

One of them is oil. Russia’s economy has really been stripped of growth capacity apart from its energy sector. Therefore, the whole system is quite susceptible to oil price changes, and the chart above both up and down looks suspiciously like the chart for WTI – especially the “rising dollar” part.

Except, as noted last week, oil prices have risen vigorously over the past several months while rubles have not. The divergence here along with the one noted for US junk (leveraged loans) is curious, if not downright indicative.

Leave A Comment