Iconic brands can often make for solid long-term dividend growth investments, thanks to the wide competitive moats and strong pricing power that are created by brand loyalty.

In fact, Warren Buffett’s dividend portfolio consists of a number of companies with extremely well-known brands, from Apple to Heinz, Pampers, and Coca-Cola.

Another great example of a company that benefits from the strength of its brands is Brown-Forman (BF-B), whose Jack Daniel’s Whiskey has become synonymous with American culture.

In fact, with 32 straight years of dividend growth under its belt (at an impressive growth rate of 9% annually), Brown-Forman is a dividend aristocrat, and one whose 21.2% annual total returns over the past three decades have vastly outperformed the broader market.

Let’s take a closer look at America’s whiskey king to see just what makes its business so appealing, what kind of growth income investors can expect going forward, and whether or not shares could be worth buying today.

Business Overview

Brown-Forman was founded in 1870 in Louisville, Kentucky, by George Garvin Brown, a pharmaceutical salesman, and his accountant friend George Forman, with $5,500 in savings and debt ($97,000 in 2016 money).

Brown-Forman has since grown to become one of the world’s dominant spirits and liquor producers, marketing numerous premium alcohol products in over 165 countries.

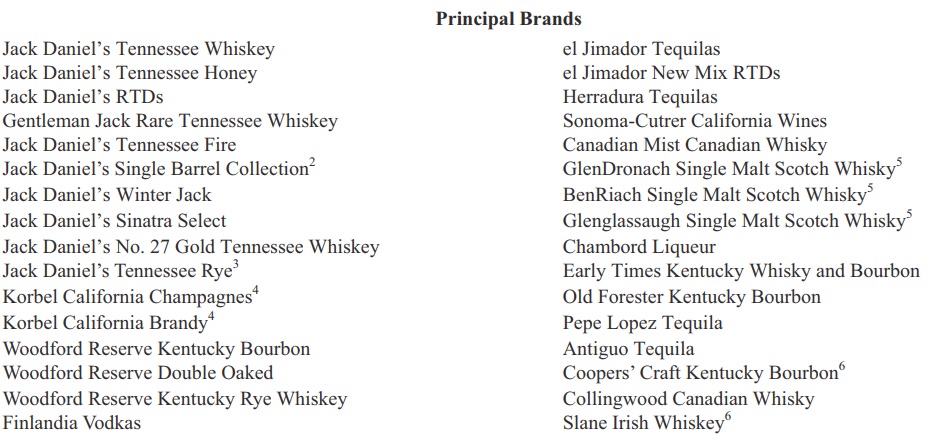

Source: Brown-Forman Annual Report

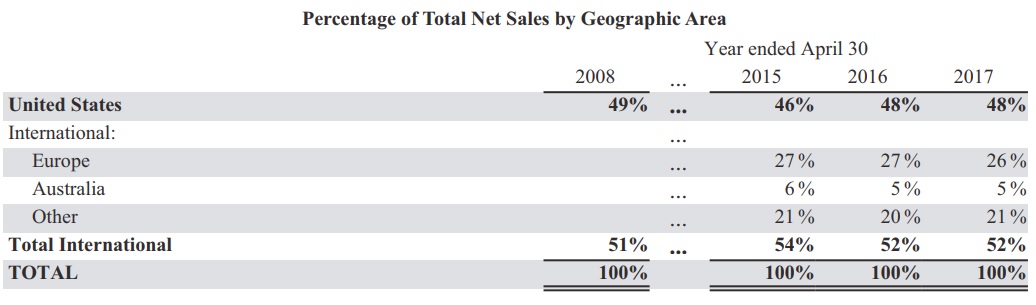

Brown-Forman’s largest and most important market continues to the the U.S., which represented just under half of total sales in fiscal 2017. However, the company’s overseas presence, especially in fast-growing markets such as Mexico, represents its best future growth opportunities.

Business Analysis

Brown-Forman possesses several major competitive advantages that have fueled its long-term success.

First, the production of spirits like whiskey and bourbon take specialized skill and time. For example, whiskey needs to be aged at least two years in charred oak barrels, and the taste of individual brands is similarly specialized due to various tweaks created in the production process.

In other words, high end spirits are not a commodity product that upstart rivals such as America’s 1,300 or so craft distilleries can easily win market share in. In fact, those 1,300 small time operators have a total market share of just 3%, compared to Jack Daniels’ 30% domestic bourbon and Tennessee Whiskey market share.

The other wide moat factor is the name brand, which is highly important to industry consumers, who have historically proven to be less price sensitive and very brand loyal.

This is why Brown-Forman spends so much on advertising ($380 million or 13% of revenue in 2016).

With an operating history dating back over 100 years and billions of advertising dollars cumulatively spent, Brown-Forman has created a loyal following of consumers who have developed a preference for the taste of its whiskeys. This has helped the company consistently raise prices and maintain excellent profit margins.

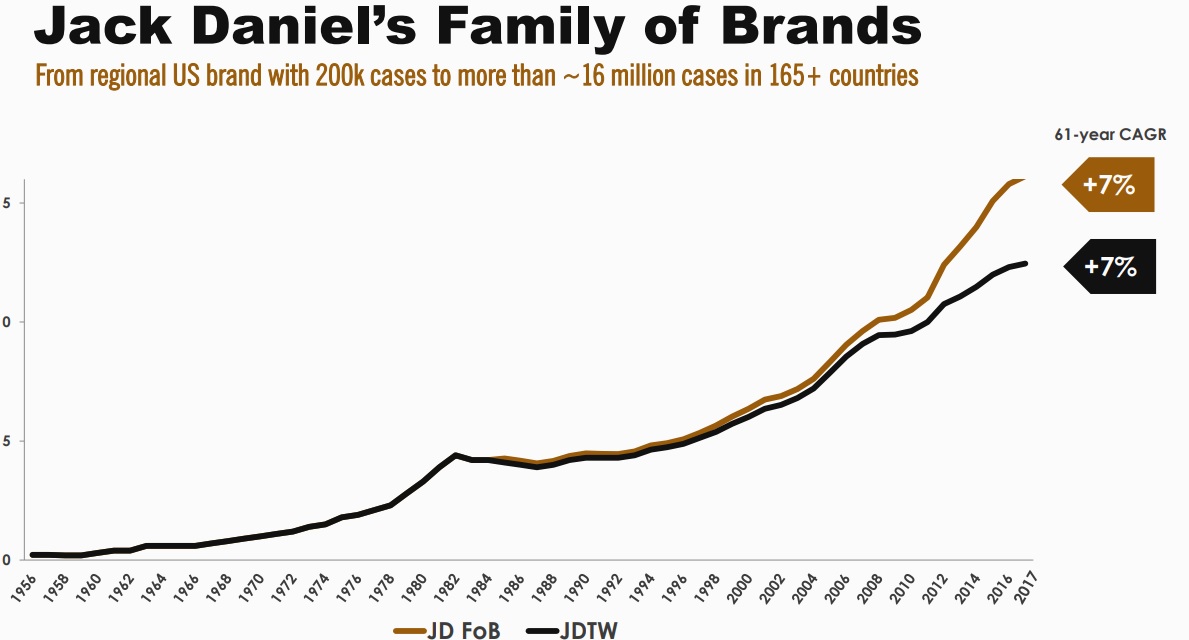

When combined with the quality of its long-term focused management, currently headed by CEO Paul Varga (over 30 year of experience with Brown-Forman), the results have been impressive, with over 61 years of consistently strong volume growth.

Source: Investor Presentation

Another major advantage is Brown-Forman’s massive, global distribution network, which includes various wholesalers, bars, grocery stores, and duty-free shops.

Replicating this network, which reaches more than 150 countries worldwide, would likely take competitors decades of time and cost millions of dollars of expenses. When Brown-Forman launches a new product, it can plug it into its distribution system to get it on the shelves quickly.

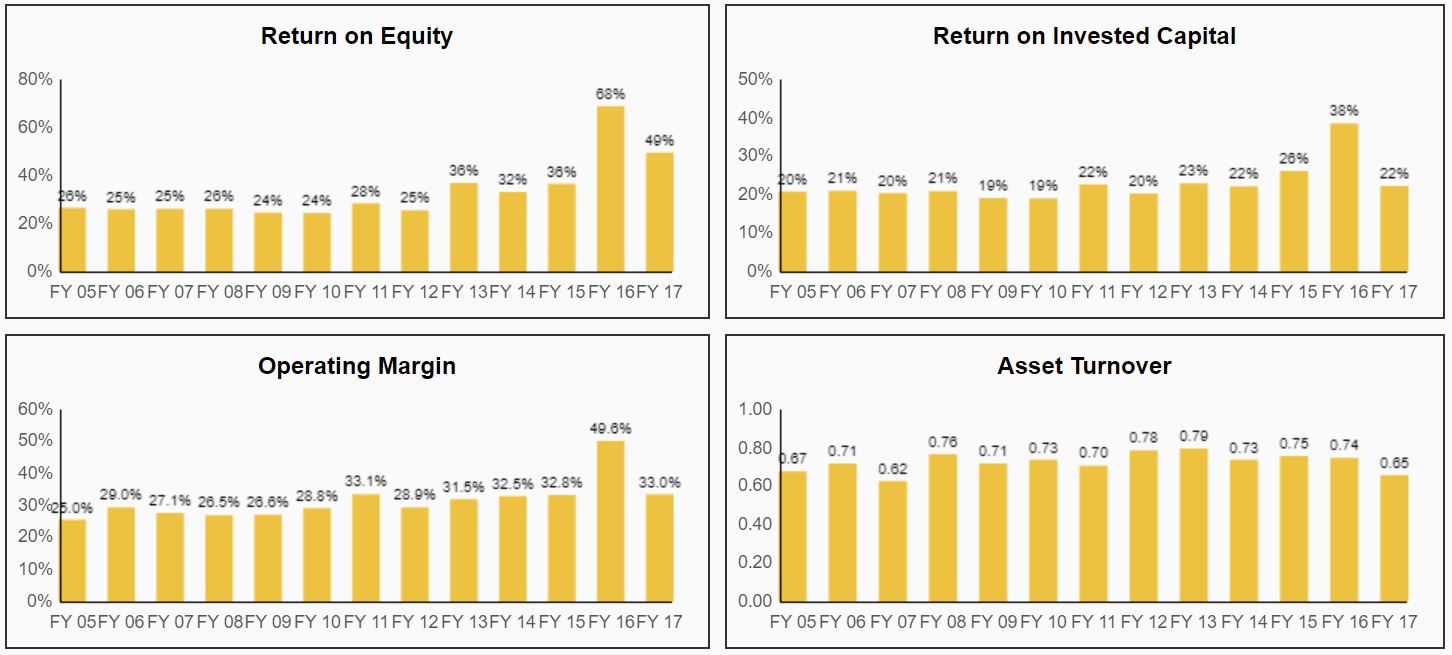

Thanks to the iconic nature of Brown-Forman’s brands, the company enjoys premium shelf space, as well as strong pricing power, which allows it to generate strong margins and returns on shareholder capital that have proven to be highly stable over time.

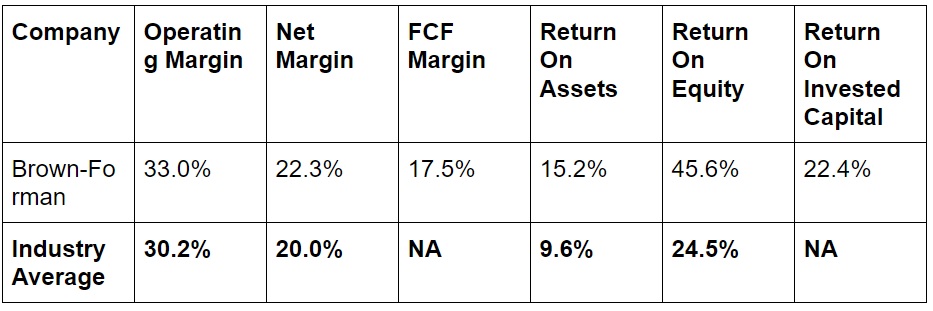

Source: Simply Safe Dividends

In fact, thanks to management’s recent decision to sell underperforming businesses, such as Southern Comfort and Tuaca, and instead focus on higher margin and faster growing brands such as Slane Castle Irish Whiskey and BenRiach single-malt scotch, Brown-Forman enjoys some of the highest profitability in an already high margin industry.

That’s despite being a very small company in absolute terms, especially compared to mega-rivals such as Diageo (DEO) and Constellation Brands (STZ).

Sources: Morningstar, Gurufocus

Best of all, because of the company’s wide distribution and marketing reach, Brown-Forman is able to achieve solid organic growth through the launching of new product lines, such as flavored whiskeys, or even break into new markets, such as its immense success with Woodford Reserve Bourbon.

Leave A Comment