The price of Bitcoin had a bad start to the week, but things quickly improved. Bitcoin Cash, that forked out of the primary digital coin back in 2017, enjoyed a boost from the Bitmain IPO in Hong Kong. The successful listing of the firm that holds BCH sent all coins higher.

JP Morgan, one of the largest banks, is moving deeper into the blockchain technology. The Quorom is based on Ethereum, but Bitcoin also gained. Is the period of consolidation over? Many crypto doubters are now finding investment in cryptos attractive.

In order to attract mainstream investors, an Exchange Traded Fund will be needed. The SEC is not rushing to take a decision anytime soon, but when it does happen, the moves could be massive.

Another positive development came from Google. The tech giant that previously announced a ban on crypto advertisements, is now taking baby steps to allow such ads in the US and Japan. Contenders will undergo a lengthy process, but this may be the first step to broader acceptance.

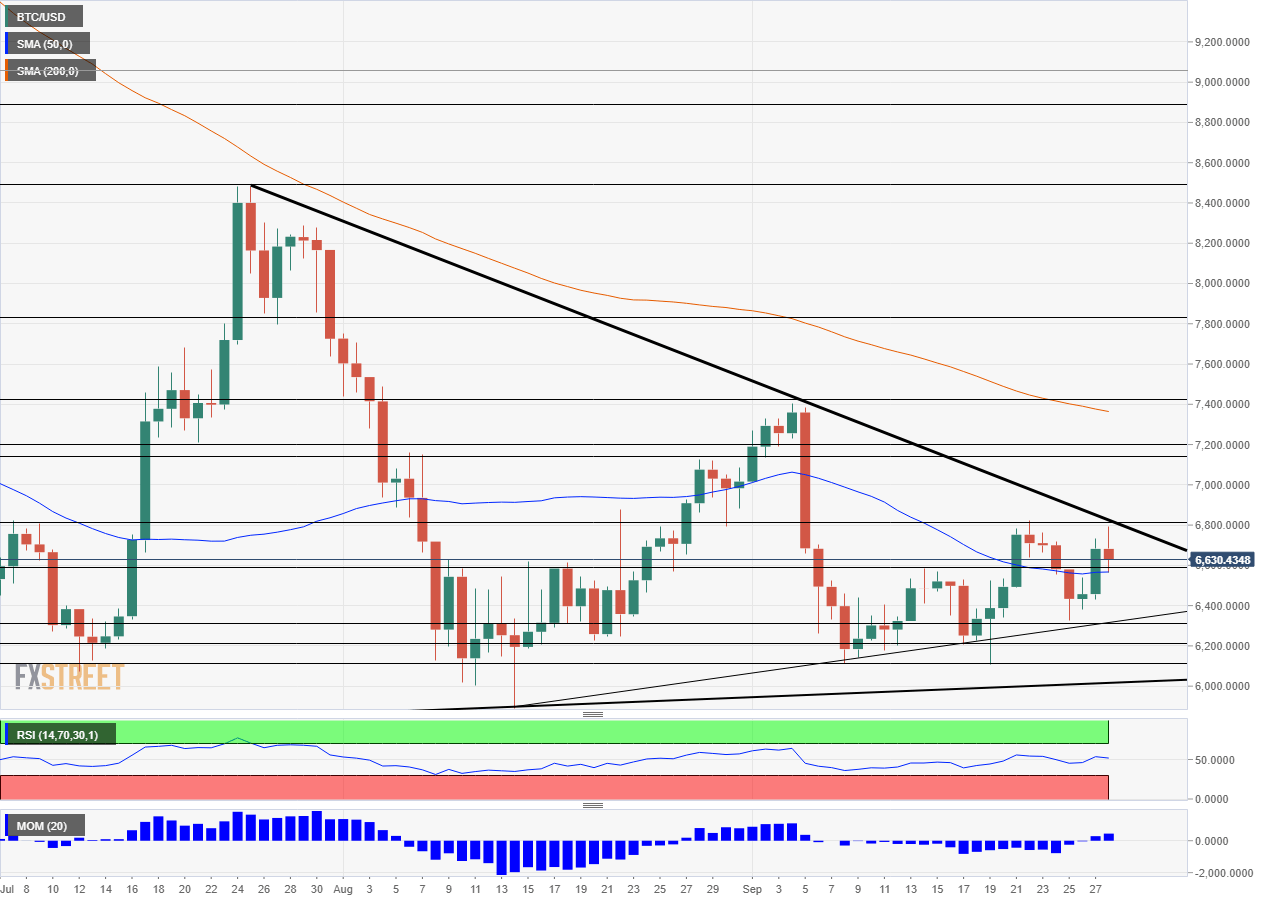

BTC/USD Technical Analysis – Downtrend resistance is critical

The BTC/USD is currently trading above the 50-day Simple Moving Average, a positive sign, but we were here before, not that long ago. The $6,800 level is key. The level capped the pair earlier in September and is also where the downtrend resistance line from July meets the price at the time of writing. Breaking higher is crucial for further upside moves.

Momentum has turned positive for Bitcoin but the Relative Strength Index is not going anywhere fast. The 200-day SMA is around the $7,400 level which is a high resistance line.

In between $6,800 and $7,400 we find the round number of $7,000. Just above, $7,150 capped the BTC/USD in late August and $7,200 provided support when it traded on high ground.

Leave A Comment