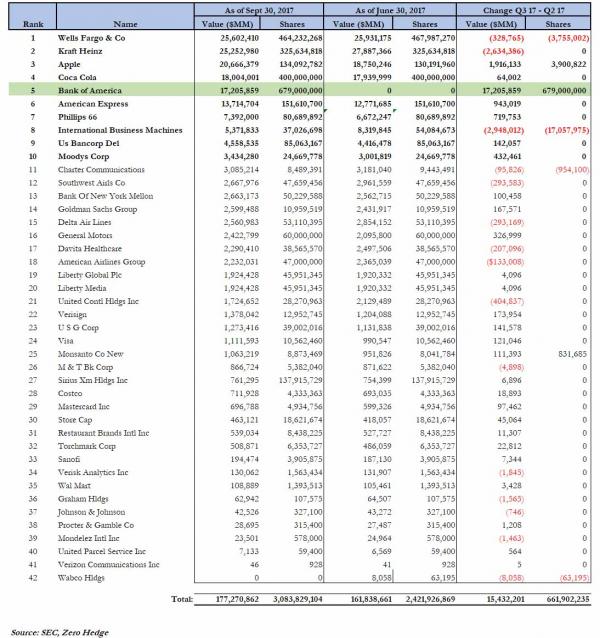

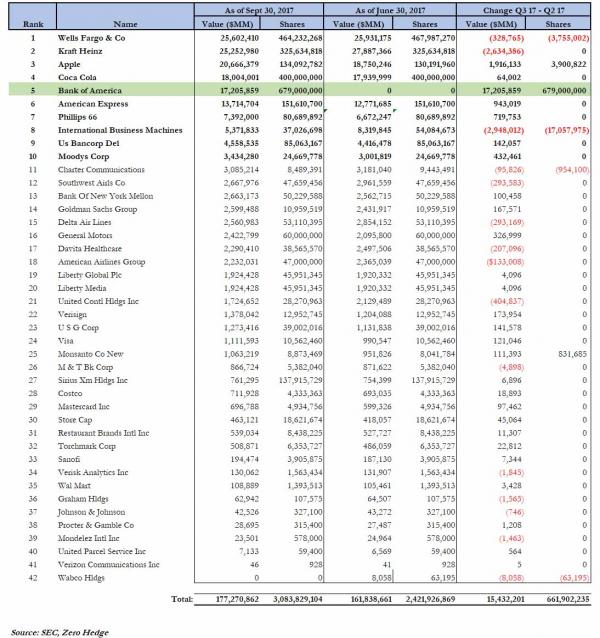

Traditionally one of the most boring, and telegraphed 13-Fs, Tuesday’s update of Berkshire holdings did not contain any major surprises, well maybe with one exception: while it was already well-known that at the end of June Buffett converted roughly 700 million Bank of America preferred shares into common, which now appear on Berkshire’s 13F, there were two notable changes.

First, Buffett continued to dump his IBM holdings, and as of the end of Q3, he held only 37 million IBM shares, down 31.5% from Q2, amounting to a little over $5 billion in notional value as of Sept 30. Berkshire also cut its stake in Wells Fargo (its biggest) modestly to 464 million shares, which is still just under $26 billion and also trimmed his Charter Communications position.

On the other end, Buffett added to his Apple holdings, increasing the total by 3.9 million shares to 134 million from 130.2 million at the end of last quarter. Buffett also added to his Synchrony Financial and Monsanto holdings.

Finally, Berkshire exited its entire Wabco position.

Leave A Comment