Hooker Furniture (HOFT – Snapshot Report) is a leading manufacturer and importer of residential furniture, primarily targeted at the upper-medium price range. The Company offers diversified products, consisting primarily of home office, entertainment centers, imported occasional, bedroom, and wall systems, across many style categories within this price range. The company is the Bull of the Day after it recently became a Zacks Rank #1 (Strong Buy).

Hooker has a market cap of $360 Million with a Forward PE of 14. The stock pays a dividend of 1.25%, but should be looked at as a growth play, with Zacks Styles Score of “A” in Growth and Momentum. In addition, the company sits in an industry that is ranked 14 out of 265 (Top 5%) of the Zacks Industry Rank.

Recent Downgrade a Buying Opportunity

BB&T Capital Markets cut Hooker Furniture to Hold from Buy last week, causing a 7% sell off in one day. Considering the stock was up 50% on the year, the reaction to the downgrade isn’t much of a surprise.The BB&T analyst reason for the cut was that its $33 price target was hit that it initiated on January 7th, a day after the company acquired Home Meridian International for $100 Million.

After a nice run up in January, Cerberus Capital founder Stephen Feinberg disclosed a 5.4% passive stake in the company. This gave investors’ confidence in the improving fundamentals of the company and pushed the stock to its recent highs.

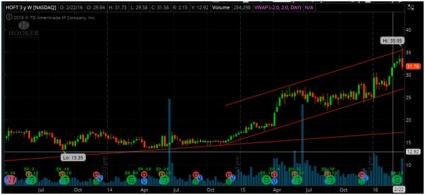

Looking at the chart below we see a bullish channel that started forming last year. We are currently in the middle of the channel with the next earnings release on April 5th. Investors might want to start long positions now as analysts are raising estimates.

Earnings and Estimates

Last quarter the company reported Q3 $0.43 versus $0.30 year over year. Revenues came in at $65.3 Million verse the $63.2 Million last year.

CEO Paul Toms Jr. had some comments about the quarter and the future of the company: “Despite this temporary slow-down, we believe the fundamentals of the economy impacting our industry are strong and we see plenty of recovery left in the housing market. Millennials are entering the life stage in which they’re beginning families and buying homes. Housing remains affordable, unemployment is low, consumer confidence is relatively high, interest rates are at historically low levels and wages are growing. We believe we are very well-positioned to continue to perform at a high level of efficiency and to capitalize on improved demand, when it returns.”

Leave A Comment