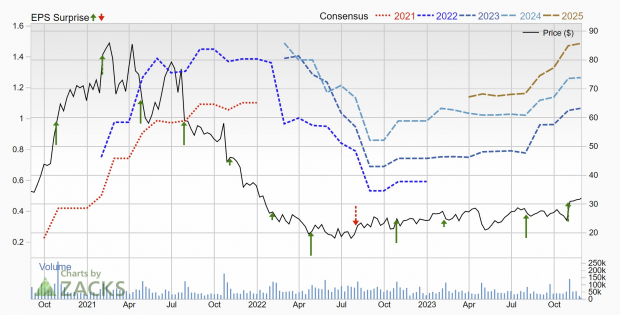

Pinterest (PINS), the social media and discovery platform with 482 million MAUs (Monthly Active Users) is a well-established and high growth technology company with a Zacks Rank #1 (Strong Buy) rating.In addition to the top Zacks Rank, Pinterest has several notable bullish catalysts making it a compelling investment consideration. The company has both a fair earnings multiple and high earnings growth forecasts giving it a discount PEG ratio. Furthermore, the stock’s price action is forming a convincing technical chart pattern giving traders a measured risk-reward setup.Investors looking to add exposure to the high growth, mid-cap technology stocks, which continue to build momentum in this bull-friendly market should read on. Pinterest is part of the Internet-software industry, which currently sits in the Top 12% (31 out of 251) of the Zacks Industry Rank. Company SummaryPinterest, founded in 2008 is a platform that shows its users (called Pinners) visual recommendations (called Pins) based on their personal taste and interests. Users then save and organize these recommendations into collections (called Boards).Pinterest generates revenue by delivering ads on its website and mobile application. The company is helping advertisers reach millennials and Gen Z audience who are more active on immersive mobile platforms.Earnings estimates have been trending higher over the last several months, giving PINS its top Zacks Rank. Current quarter earnings estimates have been revised higher by 8.7% over the last month and are expected to jump 72.4% YoY to $0.50 per share. FY23 earnings estimates have increased 11.5% in the last month and are forecast to climb 72.5% YoY to $1.07 per share.Annual sales are projected to grow 9% to $3.1 billion this year and 16.8% next year to $3.6 billion.  Image Source: Zacks Investment Research Discount ValuationAfter trading through the boom-bust market of 2020-2022, Pinterest stock is trading just 32% above its IPO price from 2019. That means investors are paying just a small premium to the IPO price, while annual sales have nearly tripled in that time.Today, Pinterest stock is trading at 30x forward earnings, while its EPS are expected to grow 36% annually over the next 3-5 years. This means that the company has a PEG Ratio of 0.84x, indicating a discount valuation based on its growth prospects.

Image Source: Zacks Investment Research Discount ValuationAfter trading through the boom-bust market of 2020-2022, Pinterest stock is trading just 32% above its IPO price from 2019. That means investors are paying just a small premium to the IPO price, while annual sales have nearly tripled in that time.Today, Pinterest stock is trading at 30x forward earnings, while its EPS are expected to grow 36% annually over the next 3-5 years. This means that the company has a PEG Ratio of 0.84x, indicating a discount valuation based on its growth prospects.  Image Source: TradingView Technical PerspectiveAfter forming a very large stage one base over the last two years, Pinterest is again drawing in buyers. Now, after a strong Q3 earnings report and gap higher, the stock has been building out a convincing bull flag from which investors can trade a breakout.If PINS stock can trade and close above the $32.30 level, it would signal a technical breakout, and likely push the stock to new two-year highs. Alternatively, if the stock reverses at the level again, and moves below the $31.50 level, investors may want to wait for another opportunity.

Image Source: TradingView Technical PerspectiveAfter forming a very large stage one base over the last two years, Pinterest is again drawing in buyers. Now, after a strong Q3 earnings report and gap higher, the stock has been building out a convincing bull flag from which investors can trade a breakout.If PINS stock can trade and close above the $32.30 level, it would signal a technical breakout, and likely push the stock to new two-year highs. Alternatively, if the stock reverses at the level again, and moves below the $31.50 level, investors may want to wait for another opportunity.  Image Source: TradingView Bottom LineThe trifecta of fair valuation, upward trending earnings revisions, and technical momentum setup makes Pinterest a worthy consideration for any investor’s portfolio. More By This Author:3 Hotchkis & Wiley Mutual Funds For Great ReturnsBest Inverse/Leveraged ETFs Of Last Week 3 Empower Mutual Funds For Outstanding Returns

Image Source: TradingView Bottom LineThe trifecta of fair valuation, upward trending earnings revisions, and technical momentum setup makes Pinterest a worthy consideration for any investor’s portfolio. More By This Author:3 Hotchkis & Wiley Mutual Funds For Great ReturnsBest Inverse/Leveraged ETFs Of Last Week 3 Empower Mutual Funds For Outstanding Returns

Leave A Comment