SYNNEX Corporation (SNX – Free Report) recently reported record revenue and profit. This Zacks Rank #1 (Strong Buy) is expected to see double digit earnings growth this fiscal year.

SYNNEX provides distribution, logistics and integration services for the tech industry, including outsourced services. It’s wholly-owned subsidiary, Concentrix, offers a host of strategic solutions including process optimization, technology innovation and front and back-office automation.

It operates across the globe.

Another Beat in the Fiscal Third Quarter

On Sept 25, SYNNEX reported its fiscal third quarter results and beat the Zacks Consensus by 17 cents. Earnings were $2.16 versus the consensus of $1.99.

Beating the estimate has become commonplace with SYNNEX.

It has only missed once in the last five years.

Revenue rose 16.5% to $4.3 billion from $3.7 billion in the year ago period.

Technology Solutions, its largest segment, saw revenue rise 15.8% to $3.8 billion while Concentrix revenue jumped 21.9% to $496 million, year-over-year.

It generated about $65 million in cash in the quarter.

Guides Higher for the Fiscal Fourth Quarter

SYNNEX continues to be bullish heading into its final quarter of the year.

Its fourth quarter earnings guidance was in the range of $2.63 to $2.73, well above the Zacks Consensus of $2.52.

As a result, 2 analysts raised quarterly and full year earnings estimates.

The fiscal 2017 Zacks Consensus Estimate jumped to $8.79 from $8.44 in the past month. That’s earnings growth of 25% as the company only earned $7.04 in fiscal 2016.

2018 earnings estimates have also been on the rise, moving up to $9.56 from $8.92 over the last month. That’s another 8.7% earnings growth.

Still a Value Stock?

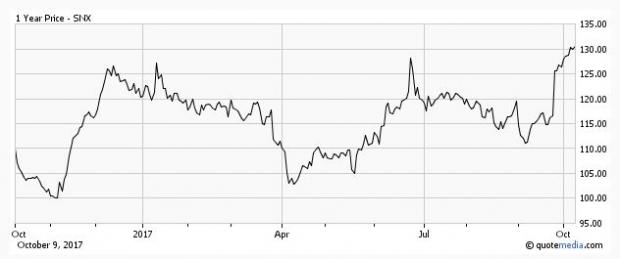

It’s been a rocky year for the shares but they have recently broken out to new 1-year highs and are up 7.8% on the year.

Shares still have attractive valuations.

They are trading with a forward P/E of 14.8, have a price-to-book ratio of 2.3 and a price-to-sales rate of just 0.3.

Leave A Comment