Universal Forest Products (UFPI – Analyst Report) has been banging up against all-time highs over the last month and is the Bull of the Day after it recently became a Zacks Rank #1 (Strong Buy).The company designs manufactures, treats and distributes lumber products for the do-it-yourself, manufactured housing, wholesale lumber and industrial markets.Its products include pressure-treated wood, engineered roof trusses, dimension lumber and value-added lumber products, including lattice, fence panels, deck components and kits for various outdoor products sold under the its PRO-WOOD, Deck Necessities, Lattice Basics, Fence Fundamentals and Outdoor Essentials trademarks.

Universal Forest is based in Grand Rapids, Michigan and had 7,000 fulltime employees. The company has a market cap of $1.7 Billion with a Forward PE of 19. The stock pays a dividend of 0.96% and sports Zacks Styles Scores of “A” in Growth and “B” in Momentum.

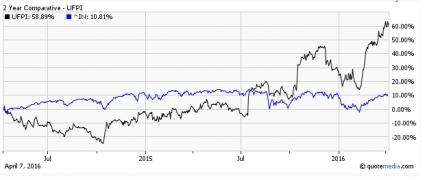

The company has seen an amazing run after a pullback to $61 in early February. UFPI currently sits around $85 which gave dip buyers a move of almost 40%.Investors must now decide whether they should wait for another pullback or chase the stock higher.Over the last two years we have seen the stock surge 60%, while the S&P is only up 10%.

Earnings and Estimates

Universal Forest reported on February 17th and saw Q4 earnings of $0.93 versus the $0.78 expected with revenue coming in at $653.6 Million verse the $661 Million. While revenue was light investors focused on the bottom line and bought the stock up to all-time highs. In addition to the headline numbers, the company reported residential construction revenue of $221.2 Million (-1.6% year over year) and retail revenue at $239.7 Million (+13.6% year over year).Industrial revenue came in at $209.3 Million, +4.7% year over year.

CEO Patrick M. Webster commented that the results come at a time when the lumber composite price was down 15.5 percent compared to the fourth quarter of last year, and down 13.6 percent for the year, reducing the company’s selling prices.

Leave A Comment