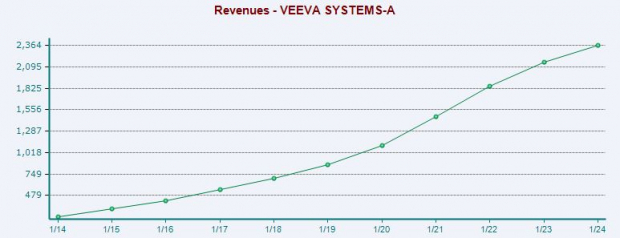

Veeva Systems Inc. (VEEV) is a cloud computing firm that serves the life sciences field, with clients stretching from pharmaceutical giants to biotech upstarts.Veeva posted strong fourth quarter results at the end of February and provided impressive guidance. VEEV stock has doubled the Zacks Tech sector in 2024 to retake some key moving averages. Yet Veeva trades 33% below its all-time highs as the wider tech sector looks a little overheated in the short term. Veeva 101Veeva sells cloud-based offerings geared toward the pharmaceutical and life sciences industries. The company helps clients improve and streamline their critical business functions, with software and services for research and development, regulatory processes and compliance, safety, clinical trials, marketing, and beyond.Veeva aims to help its clients bring “products to market faster and more efficiently” while maintaining compliance. Veeva closed 2023 (its FY24) with 1,432 customers, adding 44 from the prior year. Veeva’s R&D Solutions segment boasted 1,078 customers and Commercial Solutions finished last year with nearly 700 customers.  Image Source: Zacks Investment ResearchVeeva is one of the only tech firms that joins together clinical operations and clinical data management. Veeva’s Clinical Platform enables its customers to connect sponsors, research sites, and patients for more effective and efficient clinical trials. Recent Growth and OutlookVeeva grew its fiscal 2024 (last year) revenue by 10%, driven by a 10% increase in subscription services, which accounted for roughly 80% of total sales. The firm’s fourth quarter sales popped 12% to finish the year on an upbeat note. Veeva’s adjusted full-year earnings jumped 13%, capped off by a 20% expansion in the fourth quarter.Veeva provided upbeat revenue and earnings guidance. The firm’s adjusted earnings outlook has improved by 8% for FY25 and FY26 since its report. The company’s most accurate/recent EPS estimates are trending higher as well to help it land a Zacks Rank #1 (Strong Buy).

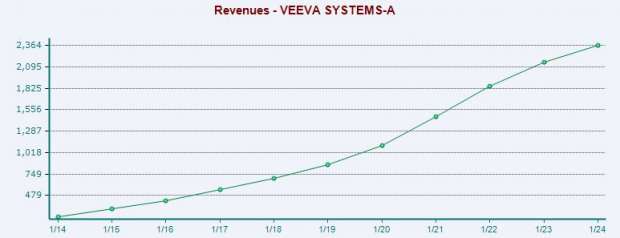

Image Source: Zacks Investment ResearchVeeva is one of the only tech firms that joins together clinical operations and clinical data management. Veeva’s Clinical Platform enables its customers to connect sponsors, research sites, and patients for more effective and efficient clinical trials. Recent Growth and OutlookVeeva grew its fiscal 2024 (last year) revenue by 10%, driven by a 10% increase in subscription services, which accounted for roughly 80% of total sales. The firm’s fourth quarter sales popped 12% to finish the year on an upbeat note. Veeva’s adjusted full-year earnings jumped 13%, capped off by a 20% expansion in the fourth quarter.Veeva provided upbeat revenue and earnings guidance. The firm’s adjusted earnings outlook has improved by 8% for FY25 and FY26 since its report. The company’s most accurate/recent EPS estimates are trending higher as well to help it land a Zacks Rank #1 (Strong Buy).  Image Source: Zacks Investment ResearchVeeva’s adjusted earnings are projected to surge 23% in its FY25 (this year) and then pop 12% higher next year, based on current Zacks consensus estimates.Veeva is expected to post 16% revenue growth in its FY25 and another 14% next year to climb from $2.36 billion last year to $3.12 billion.Current estimates mark a slowdown compared to the 25% to 35% sales growth the cloud firm posted between 2016 and 2022. But the stock has already been punished for cooling sales growth and its forecast shows progress after its 10% expansion this past year. Price, Technical Levels, and ValuationVeeva shares have doubled the Zacks tech sector over the past decade, up 611%. The stock has fallen behind during the trailing five years, up 94% vs. 132% for tech. VEEV is trending in the right direction, up 36% in the last 12 months, including a 32% surge in the past three. Despite the run, VEEV trades 33% below its 2021 peaks.

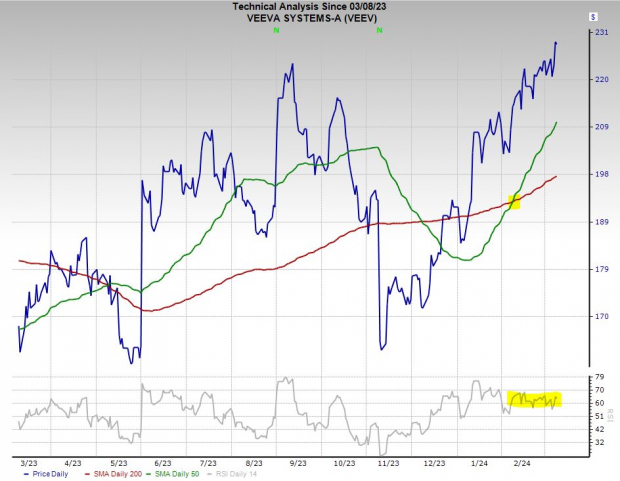

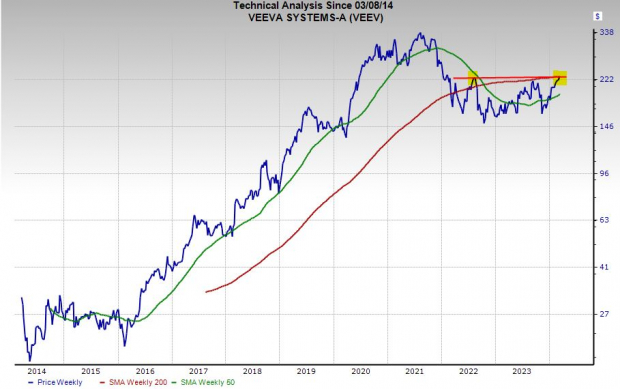

Image Source: Zacks Investment ResearchVeeva’s adjusted earnings are projected to surge 23% in its FY25 (this year) and then pop 12% higher next year, based on current Zacks consensus estimates.Veeva is expected to post 16% revenue growth in its FY25 and another 14% next year to climb from $2.36 billion last year to $3.12 billion.Current estimates mark a slowdown compared to the 25% to 35% sales growth the cloud firm posted between 2016 and 2022. But the stock has already been punished for cooling sales growth and its forecast shows progress after its 10% expansion this past year. Price, Technical Levels, and ValuationVeeva shares have doubled the Zacks tech sector over the past decade, up 611%. The stock has fallen behind during the trailing five years, up 94% vs. 132% for tech. VEEV is trending in the right direction, up 36% in the last 12 months, including a 32% surge in the past three. Despite the run, VEEV trades 33% below its 2021 peaks.  Image Source: Zacks Investment ResearchVEEV’s recent charge helps it trade above its 21-day, 50-day, and 200-day moving averages. The firm also achieved the bullish golden cross in early February, where the shorter-dated trendline climbed above the longer-term marker. The stock has found support at its 21-day average as it hovers below overbought RSI levels, similar to the Nasdaq.Veeva is on the cusp of retaking its long-term 200-week moving average, attempting to breakout above its 2022 levels and up to its records.

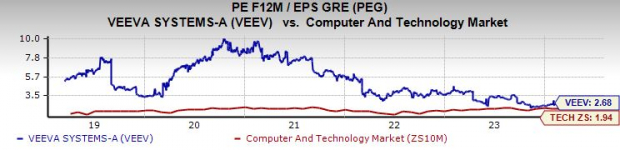

Image Source: Zacks Investment ResearchVEEV’s recent charge helps it trade above its 21-day, 50-day, and 200-day moving averages. The firm also achieved the bullish golden cross in early February, where the shorter-dated trendline climbed above the longer-term marker. The stock has found support at its 21-day average as it hovers below overbought RSI levels, similar to the Nasdaq.Veeva is on the cusp of retaking its long-term 200-week moving average, attempting to breakout above its 2022 levels and up to its records.  Image Source: Zacks Investment ResearchVeeva’s valuation levels are likely contributing to its underperformance since investors aren’t willing to pay as much of a premium for the firm amid slowing growth.But it is focused on boosting profits and its PEG ratio, which factors in its long-term earnings growth outlook, sits at 2.7. This represents a 73% discount to Veeva’s five-year highs and 40% vs. its median.

Image Source: Zacks Investment ResearchVeeva’s valuation levels are likely contributing to its underperformance since investors aren’t willing to pay as much of a premium for the firm amid slowing growth.But it is focused on boosting profits and its PEG ratio, which factors in its long-term earnings growth outlook, sits at 2.7. This represents a 73% discount to Veeva’s five-year highs and 40% vs. its median.  Image Source: Zacks Investment Research Bottom LineVeeva operates an essential business that provides investors access to biotech and pharmaceuticals without the boom-and-bust cycles common throughout those segments. Veeva boasts a stellar balance sheet, with $5.91 billion in total assets and $1.26 in liabilities, with almost no long-term debt.More By This Author:3 Standout Tech Stocks Down At Least 15% – Time To Buy?2 Leading Tech Stocks To Buy In March And Hold: TSM And NFLX Is Salesforce Stock A Buy Ahead Of Q4 Earnings As Tech Stocks Soar?

Image Source: Zacks Investment Research Bottom LineVeeva operates an essential business that provides investors access to biotech and pharmaceuticals without the boom-and-bust cycles common throughout those segments. Veeva boasts a stellar balance sheet, with $5.91 billion in total assets and $1.26 in liabilities, with almost no long-term debt.More By This Author:3 Standout Tech Stocks Down At Least 15% – Time To Buy?2 Leading Tech Stocks To Buy In March And Hold: TSM And NFLX Is Salesforce Stock A Buy Ahead Of Q4 Earnings As Tech Stocks Soar?

Leave A Comment