Vistra (VST) stock skyrocketed 125% in the first half of 2024, lagging only Super Micro Computer and Nvidia as the top-performing S&P 500 company.Vistra is thriving as Wall Street embraces the companies that will power the U.S. as the country attempts to transition away from fossil fuels at the same time as the artificial intelligence boom sends energy demand soaring.Vistra is the largest competitive power generator in the country and it’s gone all in on nuclear and other alternative energy sources poised to power the world in the coming decades. VST’s earnings and revenue growth outlook is impressive and its most recent EPS estimates showcase even stronger bottom-line expansion.On top of that, Vistra’s recent pullback sets investors up to buy VST stock at a great entry point. The Energy Transition MegatrendAI grabbed the lion’s share of the headlines so far this year. Yet three of the seven top-performing S&P 500 stocks in the first half of 2024 were new-age energy companies, including Vistra.Wall Street giants like Goldman Sachs view the global energy transition as one of the most important pillars of the U.S. economy during the coming decades.Alternative energy accounts for roughly 80% of global energy investment growth, and the International Energy Agency estimates that $2 trillion will be spent on clean energy technologies and infrastructure in 2024 alone, across wind, solar, energy storage, nuclear, the electricity grid, and beyond. Image Source: Zacks Investment ResearchNuclear is rapidly gaining steam as part of the non-fossil fuel energy push as wealthy nations, tech giants, venture capitalists, and beyond finally realize its reliability and nearly boundless potential must be unleased. Microsoft and other firms have partnered directly with nuclear energy companies to fuel their AI-focused data center expansion.The U.S. co-led in December 2023 a coalition of over 20 countries from four continents that pledged to triple nuclear energy capacity by 2050. This effort is part of a huge push from the U.S. government to spur spending and investment across non-fossil fuel energy. VST 101Vistra is an integrated retail electricity and power generation company. VST’s portfolio includes natural gas and coal, which remain vital, as well as nuclear, solar, and battery energy storage facilities.VST closed its acquisition of Energy Harbor in March to boost its zero-carbon generation portfolio. Vistra added a 4,000-megawatt nuclear generation fleet and roughly 1 million additional retail customers. The Energy Harbor deal transformed Vistra into one of the foremost integrated zero-carbon generation and retail electricity companies.

Image Source: Zacks Investment ResearchNuclear is rapidly gaining steam as part of the non-fossil fuel energy push as wealthy nations, tech giants, venture capitalists, and beyond finally realize its reliability and nearly boundless potential must be unleased. Microsoft and other firms have partnered directly with nuclear energy companies to fuel their AI-focused data center expansion.The U.S. co-led in December 2023 a coalition of over 20 countries from four continents that pledged to triple nuclear energy capacity by 2050. This effort is part of a huge push from the U.S. government to spur spending and investment across non-fossil fuel energy. VST 101Vistra is an integrated retail electricity and power generation company. VST’s portfolio includes natural gas and coal, which remain vital, as well as nuclear, solar, and battery energy storage facilities.VST closed its acquisition of Energy Harbor in March to boost its zero-carbon generation portfolio. Vistra added a 4,000-megawatt nuclear generation fleet and roughly 1 million additional retail customers. The Energy Harbor deal transformed Vistra into one of the foremost integrated zero-carbon generation and retail electricity companies. Image Source: Zacks Investment ResearchVistra owns four nuclear generation facilities, generating enough zero-carbon baseload electricity to power 3.2 million U.S. homes. Vistra owns the second-largest competitive nuclear fleet and boasts the second-largest energy storage capacity in the country. This includes one of the world’s largest battery energy storage facilities. Vistra is also actively expanding its portfolio of solar assets.Vistra said last quarter that the U.S. Inflation Reduction Act provides the opportunity to “realize material benefits with respect to its renewables and energy storage projects, as well as provide strong price support via the nuclear production tax credit for its nuclear facilities.”Vistra earlier this year started construction on two of its three larger Illinois combined solar and energy storage projects, as part of the state’s Coal to Solar and Energy Storage Initiative. Growth Outlook and EPS RevisionsThe Irving, Texas-based firm currently serves approximately 5 million residential, commercial, and industrial retail customers across 20 states, including every major competitive wholesale market.Vistra is projected to grow its revenue by 15% in 2024 and another 11% next year to reach $18.85 billion in fiscal 2025.More importantly, Vistra is projected to grow its adjusted earnings by 10% this year and 36% next year, based on current Zacks estimates. The company’s earnings revisions have surged over the past 12 months, with its FY24 consensus up 25% from where it was this time last year, while its FY25 estimate has climbed 34%.Better still, Vistra’s most accurate/recent EPS estimates came in way above consensus. VST’s most accurate Zacks estimate for FY24 is 20% above the already greatly improved consensus at $4.74 a share vs. $3.95, with FY25’s 17% higher. Vistra’s surging earnings estimate revisions help it land a Zacks Rank #1 (Strong Buy). Performance and Technical LevelsVistra shares soared roughly 125% during the first six months of 2024, lagging only Super Micro Computer and Nvidia (NVDA) in the S&P 500. VST’s performance also crushed fellow nuclear energy standout Constellation Energy’s (CEG) 75%.Vistra’s market-crushing performance is part of a 275% run in the last two years and a 230% climb over the past 12 months, blowing away Nvidia’s 205% and Constellation Energy’s 125%.

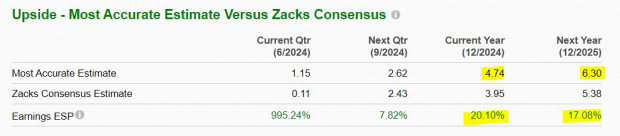

Image Source: Zacks Investment ResearchVistra owns four nuclear generation facilities, generating enough zero-carbon baseload electricity to power 3.2 million U.S. homes. Vistra owns the second-largest competitive nuclear fleet and boasts the second-largest energy storage capacity in the country. This includes one of the world’s largest battery energy storage facilities. Vistra is also actively expanding its portfolio of solar assets.Vistra said last quarter that the U.S. Inflation Reduction Act provides the opportunity to “realize material benefits with respect to its renewables and energy storage projects, as well as provide strong price support via the nuclear production tax credit for its nuclear facilities.”Vistra earlier this year started construction on two of its three larger Illinois combined solar and energy storage projects, as part of the state’s Coal to Solar and Energy Storage Initiative. Growth Outlook and EPS RevisionsThe Irving, Texas-based firm currently serves approximately 5 million residential, commercial, and industrial retail customers across 20 states, including every major competitive wholesale market.Vistra is projected to grow its revenue by 15% in 2024 and another 11% next year to reach $18.85 billion in fiscal 2025.More importantly, Vistra is projected to grow its adjusted earnings by 10% this year and 36% next year, based on current Zacks estimates. The company’s earnings revisions have surged over the past 12 months, with its FY24 consensus up 25% from where it was this time last year, while its FY25 estimate has climbed 34%.Better still, Vistra’s most accurate/recent EPS estimates came in way above consensus. VST’s most accurate Zacks estimate for FY24 is 20% above the already greatly improved consensus at $4.74 a share vs. $3.95, with FY25’s 17% higher. Vistra’s surging earnings estimate revisions help it land a Zacks Rank #1 (Strong Buy). Performance and Technical LevelsVistra shares soared roughly 125% during the first six months of 2024, lagging only Super Micro Computer and Nvidia (NVDA) in the S&P 500. VST’s performance also crushed fellow nuclear energy standout Constellation Energy’s (CEG) 75%.Vistra’s market-crushing performance is part of a 275% run in the last two years and a 230% climb over the past 12 months, blowing away Nvidia’s 205% and Constellation Energy’s 125%. Image Source: Zacks Investment ResearchInvestors who missed this stretch can buy VST 20% below its late May peaks. VST is also trading 32% below its average Zacks price target. Vistra is attempting to hold its ground at its 50-day moving average while trading at its lowest RSI levels since the market bottomed in October. Bottom LineVistra is poised to thrive as more of Wall Street grasps that VST and a few other key energy companies are set to benefit directly from soaring AI-based energy demand as the U.S. attempts to transition away from fossil fuels.The momentum behind alternative, clean, and renewable energy is monumental and seemingly unstoppable. Vistra stock helps investors gain exposure to that key megatrend. Plus, Vistra pays a dividend and trades at a 35% discount to the Utilities sector and 37% below Constellation Energy with a PEG ratio of 1.06. More By This Author:Bear Of The Day: Mastercraft Boat Holdings, Inc. Buy This Top-Ranked Growth Tech Stock Trading 40% Below Its Highs?Micron And Nike Earnings: Buy The Soaring Ai Stock And The Beaten-down Retailer?

Image Source: Zacks Investment ResearchInvestors who missed this stretch can buy VST 20% below its late May peaks. VST is also trading 32% below its average Zacks price target. Vistra is attempting to hold its ground at its 50-day moving average while trading at its lowest RSI levels since the market bottomed in October. Bottom LineVistra is poised to thrive as more of Wall Street grasps that VST and a few other key energy companies are set to benefit directly from soaring AI-based energy demand as the U.S. attempts to transition away from fossil fuels.The momentum behind alternative, clean, and renewable energy is monumental and seemingly unstoppable. Vistra stock helps investors gain exposure to that key megatrend. Plus, Vistra pays a dividend and trades at a 35% discount to the Utilities sector and 37% below Constellation Energy with a PEG ratio of 1.06. More By This Author:Bear Of The Day: Mastercraft Boat Holdings, Inc. Buy This Top-Ranked Growth Tech Stock Trading 40% Below Its Highs?Micron And Nike Earnings: Buy The Soaring Ai Stock And The Beaten-down Retailer?

Leave A Comment