The recent sell-off in technology could be a signal that equities are in a bull trap.

The market wants you to feel good here, it wants you to buy the dip just you like you have the last 458 times since 2009 when the stock market sold off. But with the FOMC Statement coming out tomorrow, we could be seeing the market set traders up with a bull trap.

There is a lot of volume pouring into the market right now, and the bounce isn’t what I would necessarily call impressive, and it would seem to me that the smart money is using the automated dip buying programs to dump some of their positions.

I could be wrong, but we shall soon see.

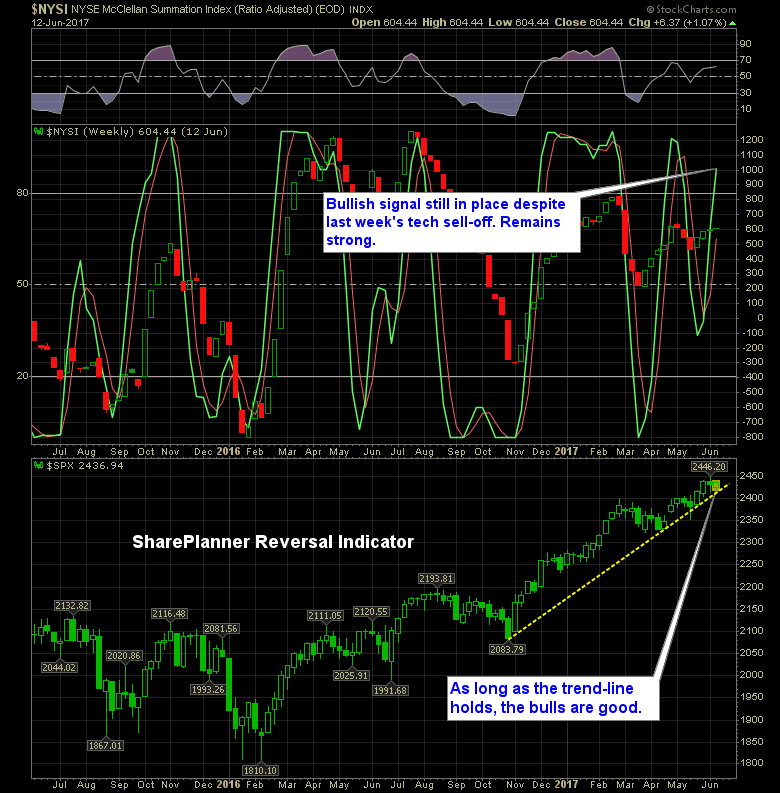

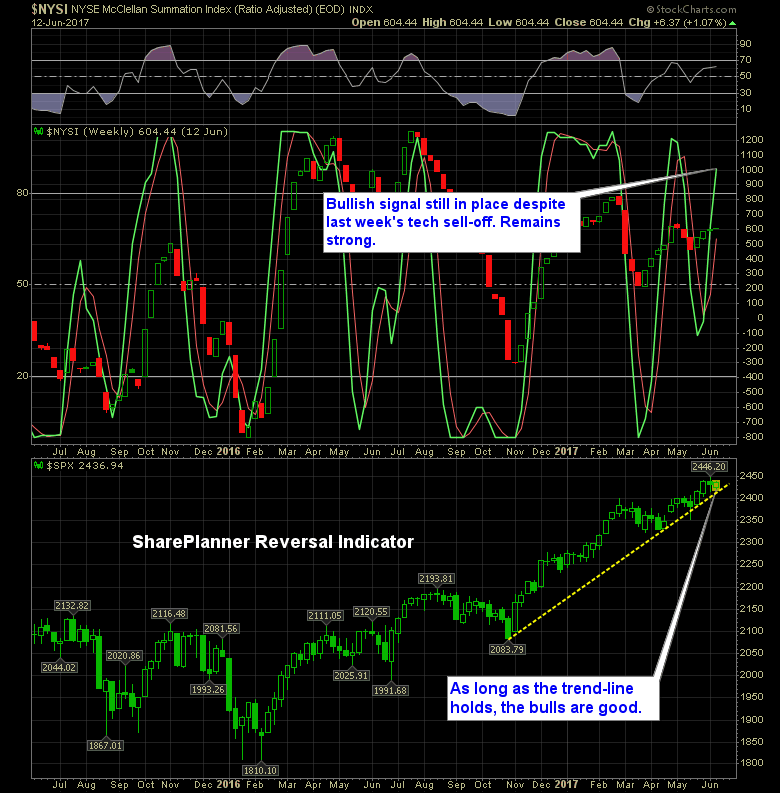

As for the SharePlanner Reversal Indicator, the bullish thesis is still in good shape, as the Dow and S&P 500 continue to trade at their all time highs. But the original reversal point came early and it is already in its latter stages. So be careful with how bullish you decide to get and make sure that price action validates your decision making.

Here’s the SharePlanner Reversal Indicator:

Leave A Comment