(This is an excerpt from an article I originally published on Seeking Alpha on January 15, 2016. Click here to read the entire piece.)

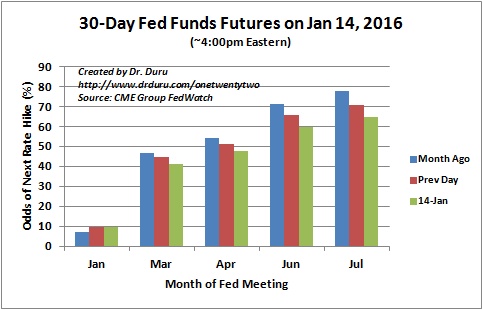

These were the main conclusions made by James Bullard, President and CEO, Federal Reserve Board-St. Louis, in a speech on January 14th titled “Oil Prices, Inflation and U.S. Monetary Policy.” Bullard effectively pushed out the path of inflation and in so doing pushed out the timing of the next rate hike from the Federal Reserve. The Fed Funds Futures reacted by pushing out the odds for a rate hike in April, already marginal, all the way out to June.

Odds for the next rate hike have moved from a marginal April expectation to a June expectation.

Source: CME Group FedWatch

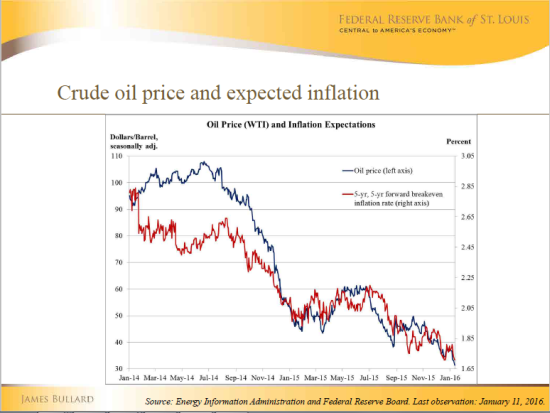

Inflation expectations are tumbling along with oil.

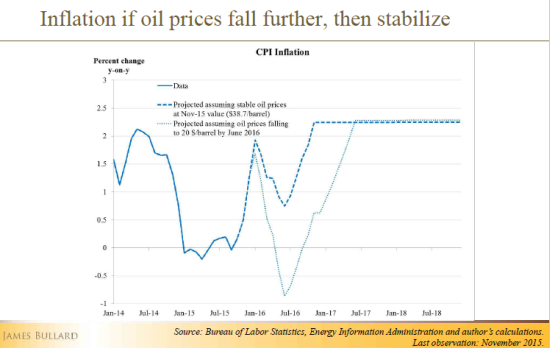

$20 oil shifts inflation stabilization out to early 2017

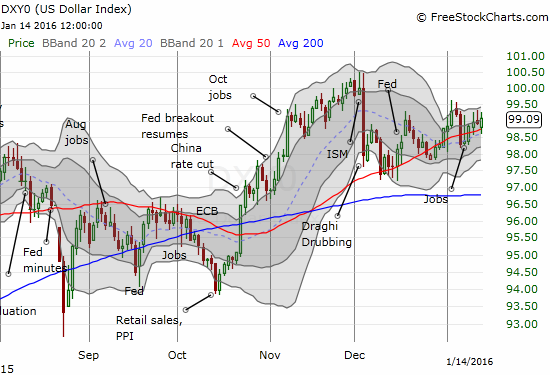

Under these circumstances, it makes sense that the market pushed out the next rate hike to June. Per my claims last year, I fully expect the Federal Reserve to follow the market’s rate expectations. Surprisingly, the U.S. dollar index (UUP) proved resilient to this shift.

The U.S. dollar is off its recent highs, but still (marginally) positive for the year as it follows support at its 50-day moving average.

Source: FreeStockCharts.com

Be careful out there!

Leave A Comment