United Airlines new policy…

My new favorite United Gif pic.twitter.com/UoY3RUZcxh

— John Puma (@JohnPuma) April 11, 2017

Gold leads in 2017 as geopolitical risk finally begins to get priced in…

In no particular order:

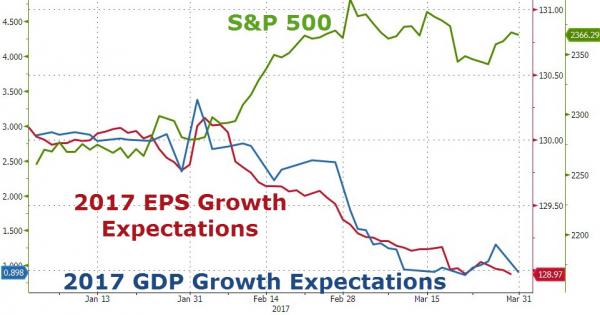

But apart from that, US Hard Data at one year lows, Soft Data at record highs predicated on Trump tax/stimulus plan – looks increasingly uncertain

Stock valuations are at or near record highs…

And earnings and economic expectations are tumbling…

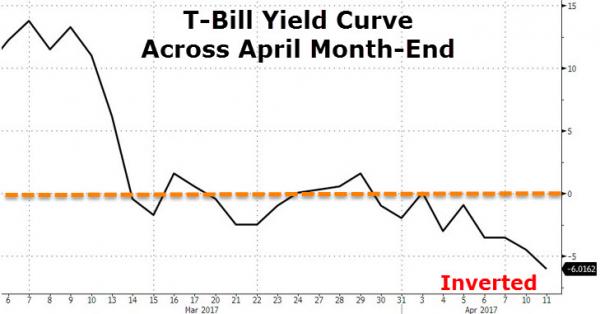

And US Government shutdown looms

***

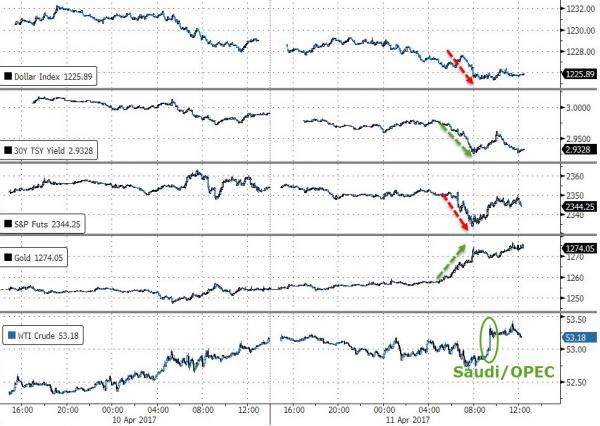

Ok so having got that off our chest – here’s what today looked like across asset classes… Bonds and Bullion were the safe havens as the dollar was dumped, crude spiked on Saudi/OPEC headlines but could not follow through…

Trannies and Small Caps up on the week, and despite the late minute ETF rebalance panic bid, The Dow, S&P, and Nasdaq ended red on the week…

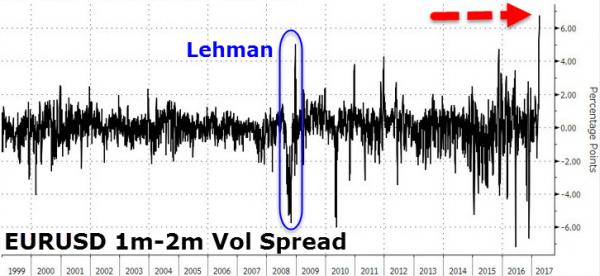

VIX spiked to post-election highs…

VIX almost reached 16 in traday…

The Dow clung to its 50DMA after breaking below it…

Tech stocks are down 8 days in a row, the longest losing streak since before the election…

Bank stocks have been a one-way no brainer trade since the spike after trump’s speech to congress…

USDJPY was clubbed like a baby seal…

Treasuries erased all post-payrolls, post-Dudley losses with yield tumbling and the curve flattening….

Oil’s spike supported stocks in the afternoon until NYMEX close…

Leave A Comment