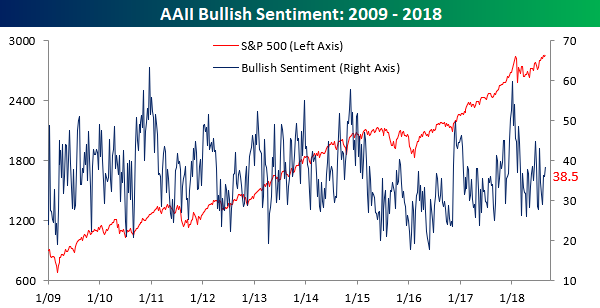

The media has been all over the place (wrongly) proclaiming that the current bull market is the longest ever while the S&P 500 touched an intraday all-time high earlier this week, so surely investor sentiment must be up to the rafters. Right? Not exactly. In this week’s sentiment survey from AAII, bullish sentiment increased from 36.2% up to 38.5%. That’s slightly above average, but with the market right near all-time highs in what is supposedly the longest bull market ever, one would think that investors would be a lot more confident. Or maybe they just know fake news when they see it!

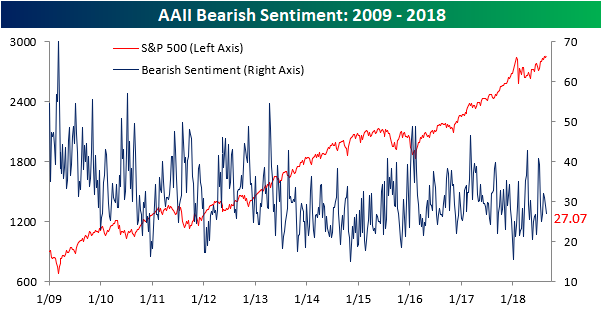

With the increase in bullish sentiment, bearish sentiment ticked lower, falling from 29.1% down to 27.1%. That represents the third straight weekly decline but is only the lowest reading since late July. Hardly a sign of complacency.

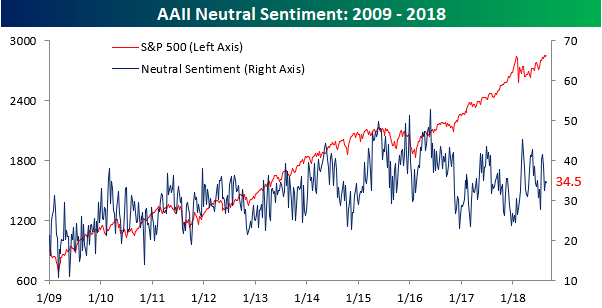

Finally, more than a third of individual investors surveyed consider themselves neutral. Again, when one out of every three investors can’t decide if they are bullish or bearish, it is not the picture you would envision years into a bull market where the S&P 500 is flirting with record highs.

Leave A Comment