With the S&P 500 down in two of the last three days, investors are once again on the defensive causing bullish sentiment to retreat. According to this week’s sentiment survey from AAII, bullish sentiment declined from 36.91% down to 28.4%. While anything sub-30% is considered low, we actually saw a lower weekly print back in the first half of April when bullish sentiment dropped down to 26.09%. One trend that is emerging in bullish sentiment, though, is just like the trend of the overall market- lower highs. Since peaking at close to 60% earlier this year, we have seen a steady downtrend emerge in sentiment where each week that has an increase is followed by another week(s) with bigger declines.

Not all the investors that left the bullish bandwagon this week went bearish. While bullish sentiment declined over 8 percentage points, bearish sentiment increased by less than 5 points. At the current level of 30.25%, it is nowhere near its recent high of over 40%.

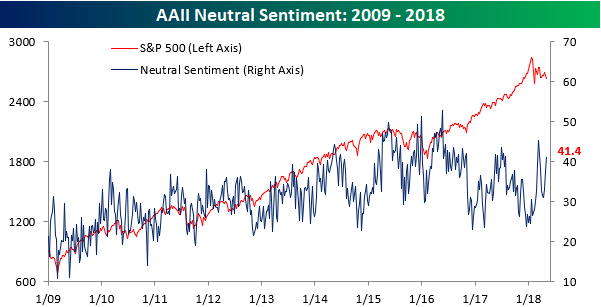

Neutral sentiment, on the other hand, is getting back up near its highs and is back above 40%, indicating that a lot of investors simply don’t know what to make of this market.

Leave A Comment