My Swing Trading Approach

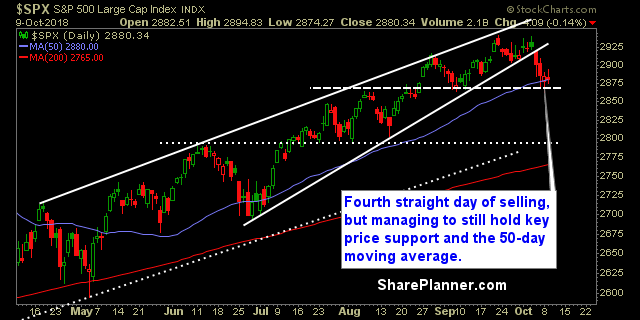

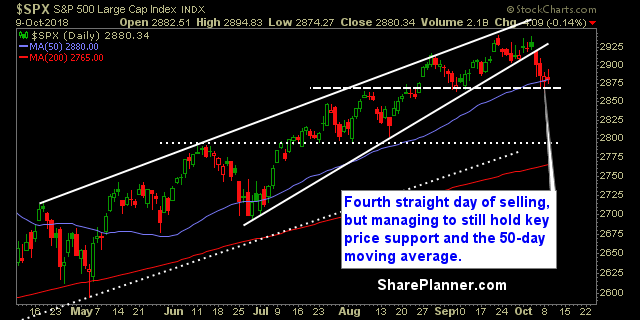

I booked my profits in NFLX at $354 for a +3.2% profit yesterday. I added one additional long position, but that is all I am working with in this market. I am not looking to get aggressively long, and may even flip to the short side, if the bulls lose the 50-day moving average.

Indicators

Sectors to Watch Today

Energy breaking out of its bull flag pattern yesterday, while Utilities continues its push higher. Healthcare continues to see profit-taking as it is now trading below its 50-day moving average. Financials on the verge of testing a key support level that if it breaks will send it back to its June lows. Technology sold off for the sixth time in the last seven trading sessions, and due for a hard bounce here off the 200-day moving average.

My Market Sentiment

The 50-day moving average barely held, and price support in the short-term is holding it together as well. The bulls continue to buy the dip at these levels and nearing oversold levels, while some sectors have already reached that. The market eventually bounces hard, so if you are short over the past week, you need to be protecting profits here. The potential for a bounce looms large.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment