A solid close to the week helped advance Thursday’s recovery. Tech Averages had the best of the action. Any short trades should be covered as the nature of the price action has shifted more sideways to bullish.

The Nasdaq 100 cleared declining resistance with a new bullish cross in relative performance. There was also a ‘buy’ trigger for On-Balance-Volume and MACD. Next tests are 6,856 and 7,000.

The Nasdaq also cleared declining resistance as relative performance advanced. The next challenge is 7,319 then 7,505.

The S&P is still caught inside its declining channel but the latest bounce off the 200-day MA looks to have merit. Technicals are mostly in the red as relative performance struggles to recover since March’s reversal.

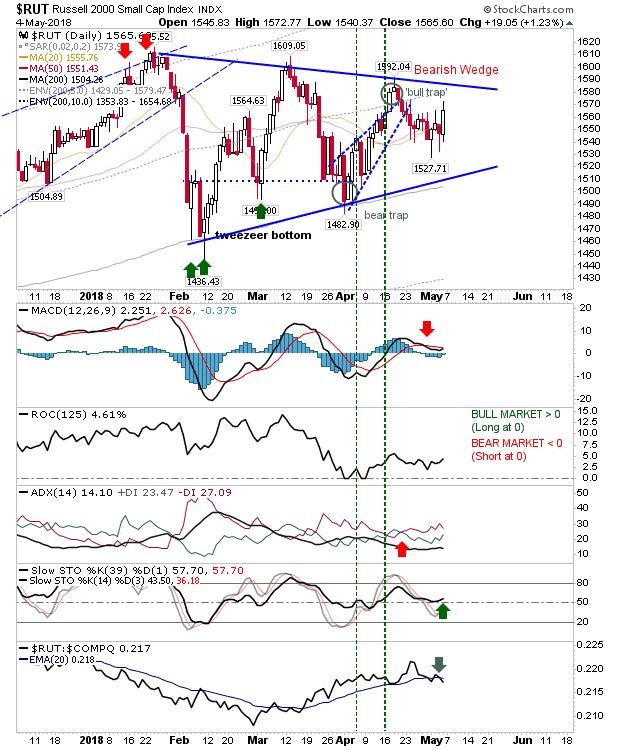

The Russell 2000 saw a relative loss in performance as the index continues to trade inside its ascending triangle. The bearish wedge is still in play although the follow through higher following two spike lows suggests bears will struggle to deliver on the bearish wedge target. Another tick in the bulls’ column is the bounce higher off the mid-stochastic line.

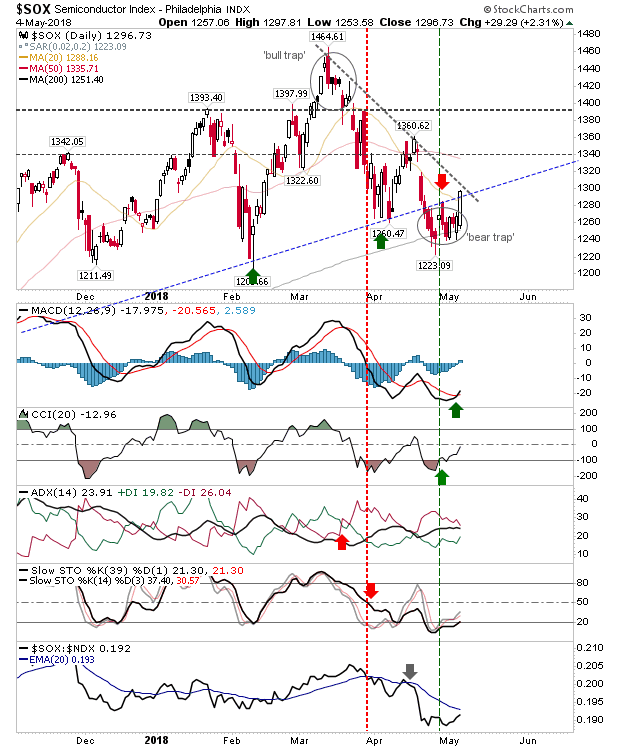

The other index to watch is the Semiconductor Index. It has rallied off its 200-day MA and in the process left behind a sizable ‘bear trap’.

For tomorrow, play for a retention of gains with a close at or above Friday’s highs. Watch for a gap higher and sell-off particularly if the selling continues beyond the first 30 minutes of trades.

Leave A Comment