My Swing Trading Approach

Yesterday the market took a much-needed break, but overall it is still running hot over the past week. I am a bit light on my end, so I’ll likely look to add more long exposure today, if the market conditions will afford me the opportunity.

Indicators

Sectors to Watch Today

Financials are still running hot, and there appears to be plenty of upside in this sector still. Technology still hasn’t established new all time highs just yet, though it is close. Still in an upward trend, though only creating nominal higher-highs and higher-lows. Industrials struggled yesterday, but still a solid uptrend in place off of the June lows. Energy is directionless.

My Market Sentiment

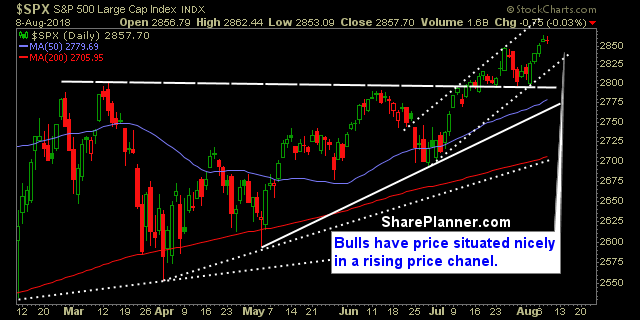

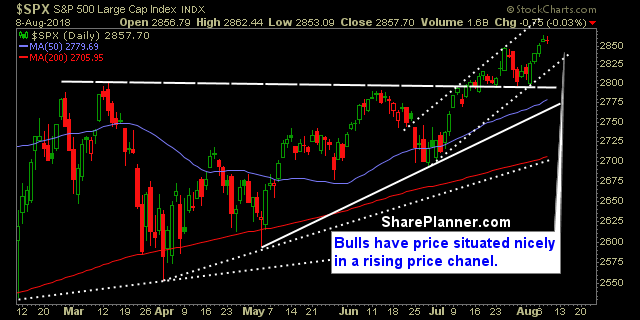

Bulls snapped a four day win streak yesterday on SPX. I would not be surprised if there is some consolidation at this point, or a possible rise to the all-time highs established in January, before getting quickly rejected.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment