With the first quarter largely over, the S&P 500’s profit decline so far comes in at just over seven percent, the worse quarterly profit decline since 2009. It is also the first time quarterly profits have fallen for four straight quarters since the third quarter of 2008 kicked off the last “profit recession”

With the S&P roughly flat for the year, it also means that based on earnings the market is more expensive from a multiple perspective than it was to begin 2016; hardly a reassuring thought. I realize this is looking a bit in the rear view mirror, but it hardly gets more assuring looking forward. Earnings in the second quarter are also expected to be down for the S&P 500 for the fifth quarter in a row although to a slightly lesser extent than what was delivered in the first quarter. GDP growth is also expected to pick up, but only to approximately two percent in the second quarter after the first quarter’s dismal .5% GDP reading.

So, where am I finding some value in what I consider an overvalued market right now? One good place to find some ideas to research is to look at what company insiders find enticing and are still buying. Here are a few that look like good values in the current market environment.

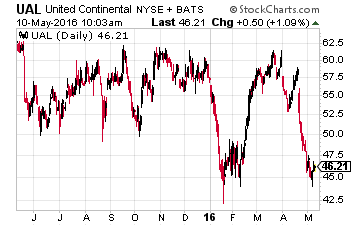

Let’s start with United Continental Holdings (NYSE: UAL), the stock of this airline has fallen from roughly $60.00 a share to around $45.00 over the past few months. That has drawn the interest of myriad insiders who have bought over $5 million worth of stock since March in over 10 separate transactions. Airline stocks have been hit lately on concerns around the growth of capacity and rising oil prices.

However, at four times trailing earnings, a lot of bad news seem baked in the current stock price at the moment. There is also more pricing discipline in the industry as mergers have shrunk the remaining carriers to a handful. The company reported earnings in late April that beat bottom line consensus by a nickel a share. In addition, two activists, PAR Capital and Altimeter Capital Management, have acquired over seven percent of the outstanding float and should ensure management focuses on shareholder value. Finally, with a glut of inventory and anemic worldwide demand, it is hard to see crude spiking from its current levels outside some major geopolitical event, so jet fuel prices should remain under control.

Leave A Comment