iStock.com/gustavofrazao

The Recent Sell-Off Says a Stock Market Crash Could Be Ahead

With the recent sell-off in the stock market, investors are asking, what’s next? Is the price action foretelling a stock market crash ahead or is it time to “buy the dip?”

Mark these words; a broad market sell-off could be brewing. Stock investors, beware.

There are several things investors need to watch for ….

Short-Term Trend Breaks, Could a Stock Market Crash Follow?

One of the biggest things to watch is the trend. Talk to any technical analyst and they will tell you that the trend is your friend until it’s broken.

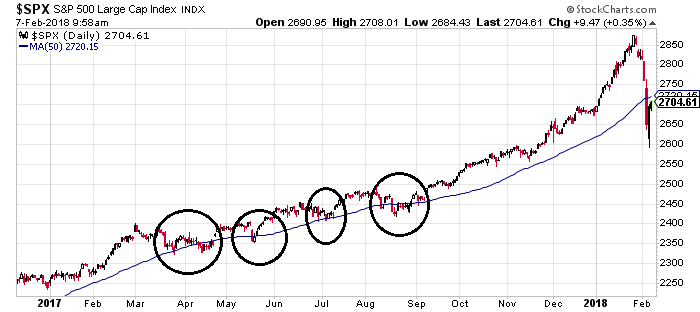

With this said, please look at the chart below of the S&P 500 and pay close attention to the blue line and circles drawn on the chart. The blue represents the 50-day moving average of the index.

Chart courtesy of StockCharts.com

Notice something interesting?

Before going into any details, know that the 50-day moving average is regarded as an intermediate-term trend indicator. If an asset is trading above the average, it means the trend is pointing upwards. If this average is below the price, it means the trend is pointing downwards.

In the recent sell-off, we witnessed the S&P 500 break below its 50-day moving average for the first time in a year. At its core, this is telling us that the trend is broken. So there could be a sort of stock market crash scenario in the books.

Fear Index Suggests Investors Are Fearful

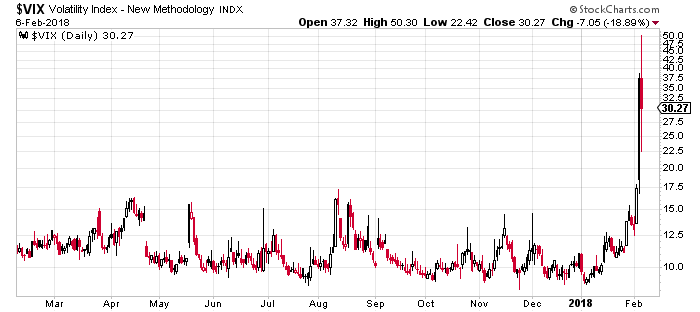

Then, pay attention to the Chicago Board Options Exchange Volatility Index (VIX), often called the “Fear Index.”

This index is suggesting a major stock market crash could be ahead as well.

Please look at the chart below:

Chart courtesy of StockCharts.com

In the beginning of 2018, the fear index traded as low as around 9.00. It now trades at above 30.00 and went as high as 50.00 in the midst of the recent sell-off on the key stock indices.

Leave A Comment