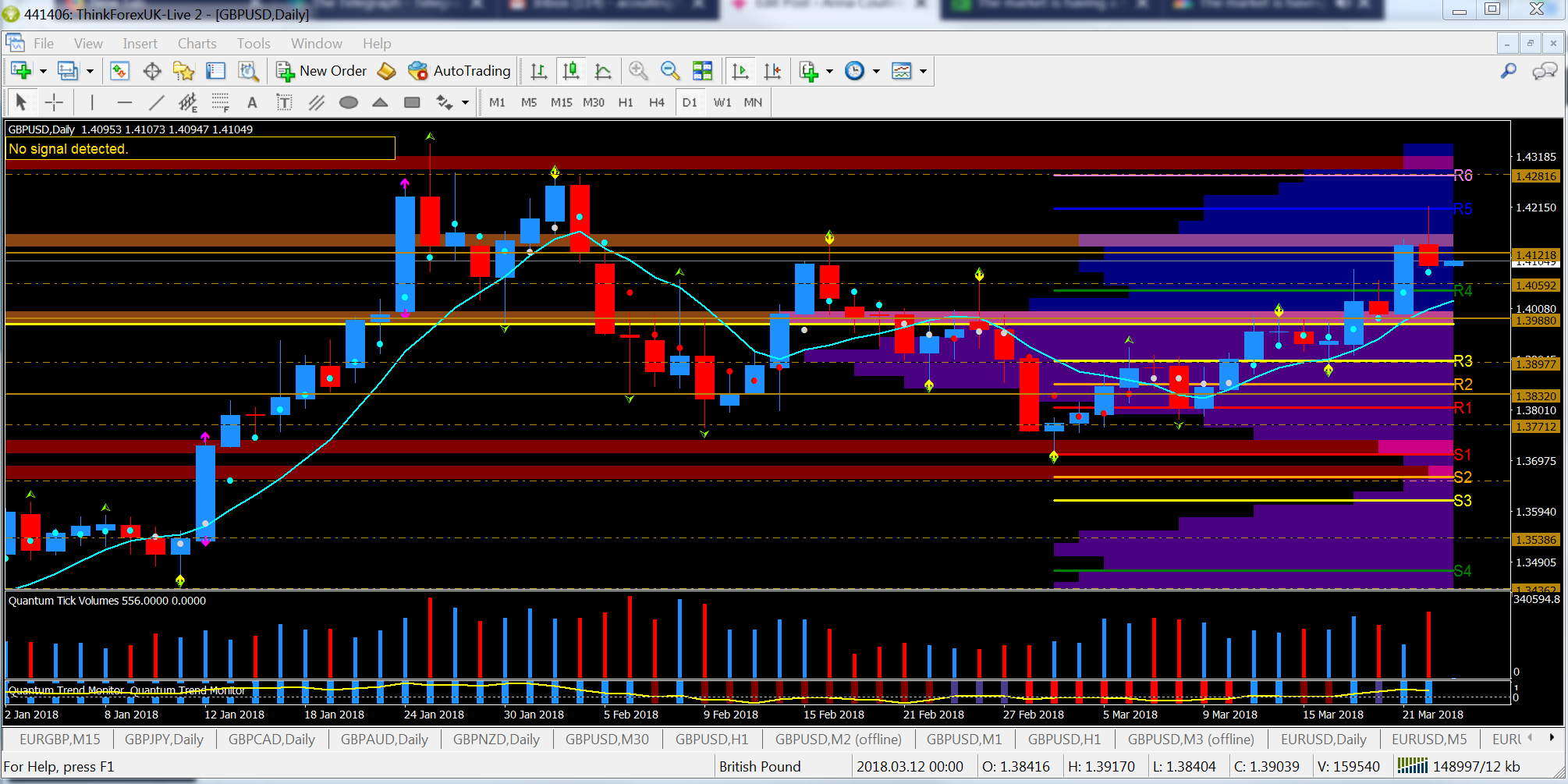

Just a quick catch up with what has been happening with Cable following the FOMC and the BOE earlier today, and all we can say is that from a price action perspective it’s been very much a game of two halves. Powell’s first outing as Fed chair saw the USD fall sharply resulting in a strong move higher for cable that saw the pair break and hold above our first upside target of 1.4121, with this bullish sentiment then carrying over into this morning’s London session with the pair then spiking through our second upside target of 1.4212. This spike higher was prompted on the unexpected news that two members of the BOE were in favour of an immediate rise in interest rates. However, this move higher was soon countered on the release of the minutes where the consensus appears to be for a gradual and limited rise. This was enough to reverse sentiment in cable with the pair falling over 120 pips as a result, since when the pair has been attempting to find some support in the 1.41 region.

Setting aside for one moment the extent to which central bank rhetoric appears so contradictory, from a volume price analysis perspective yesterday’s candle and volume bar for cable was anomalous, and contra to Wyckoff’s third law of effort and result. This law is very straightforward and states that ‘effort and result must be in agreement. In other words, the volume which is the effort must be in agreement with the outcome of the price action, or the result. If there is high volume, then we should expect to see a significant move in the price which matches the effort. If not, then this is an anomaly and is sending a signal that something is wrong’.So despite today’s spike higher in price yesterday’s candle and volume were already suggesting weakness ahead.

And just as traders have been trying to get to grips with what is likely to be central bank monetary policy moving forward, Donald Trump’s proposed tariffs against China announced during the writing of this post have unleashed a wave of volatility onto the markets resulting in a sharp move higher in the VIX, and significant falls in the indices.

Leave A Comment