Companies even in struggling industries can find new avenues for growth.

Consider Callaway Golf (ELY– Get Report) . The Carlsbad, Calif.-based company’s stake in privately held, golf entertainment venue TopGolf is proving to be a smart investment for the company. Although the company’s share price has languished in the $8-to-$10 range for the past year, investors may want to give Callaway a closer look, particularly given the TopGolf initiative.

Callaway acquired a 20% stake of TopGolf, a growing golf/entertainment business. TopGolf has performed well even as golf’s popularity has declined. TopGolf’s innovative, fun atmosphere may help reverse that trend or at least slow it as the company brings new people to the sport. Callaway’s estimated roughly $50 million investment may have already doubled.

TopGolf drew 8 million visitors last year and has ambitious plans to expand.

TopGolf is much more than just a driving range; rather, it is an interactive golf experience. Every facility has micro-chipped Callaway golf balls that provide instant feedback to players. Golfers tee off from a ‘hitting bay’ onto a landscaped driving range with targets ranging in distance from 20 to 215 yards. Golfers learn how far they have hit a shot and are allocated points based on distance and accuracy.

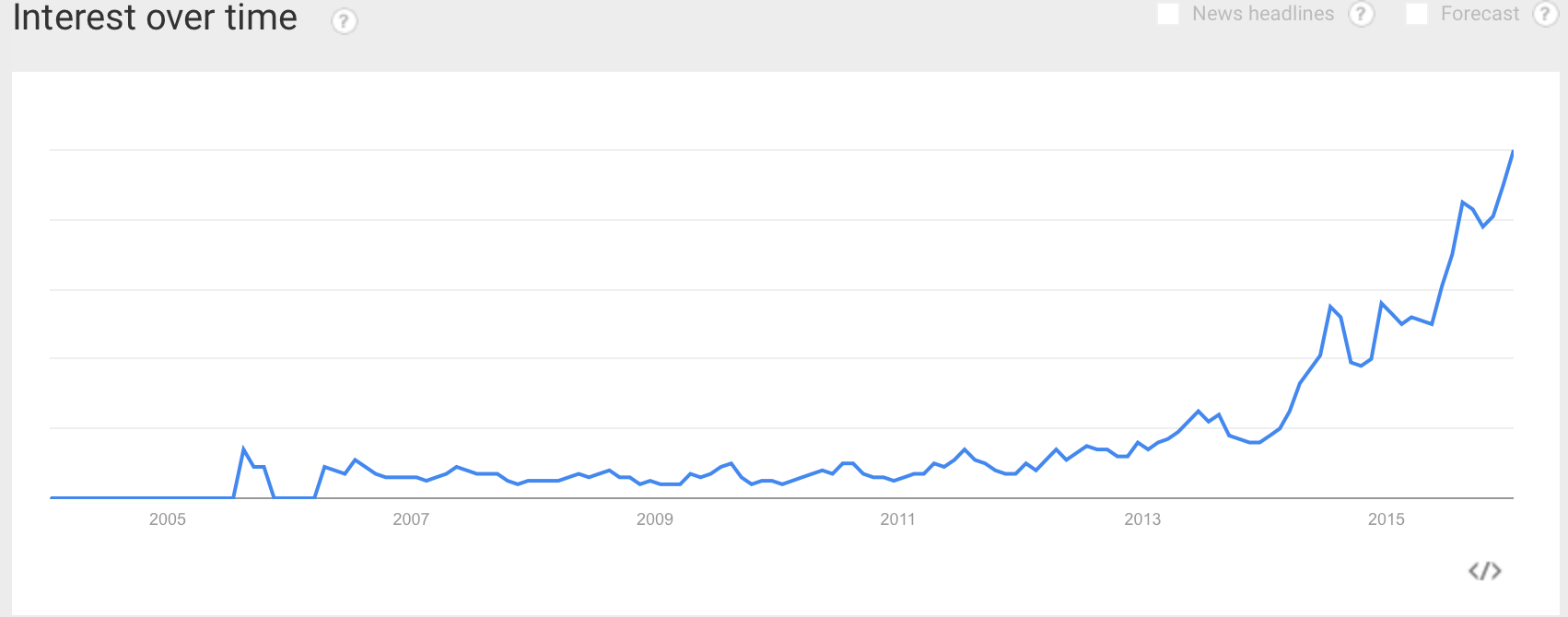

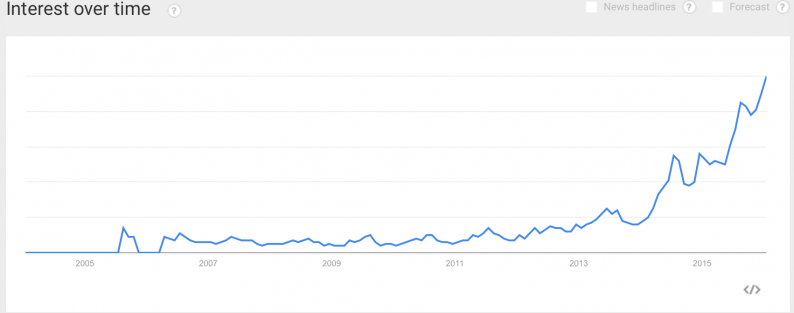

The companies considers itself as much an entertainment venue as a sports operation, providing a full bar and restaurant at venues. TopGolf continues to grow in popularity as seen in this Google trends chart.

TopGolf was founded in the UK and currently has 24 locations, 21 in the United States. Several new locations are currently under construction, including one in Las Vegas at the MGM Grand Hotel. This venue is scheduled to open this spring and will hire more than 850 employees.

TopGolf is also growing internationally. Australia, Dubai, France, Russia, South Africa, and Spain are all set to get their own TopGolf facility in the near future.

Leave A Comment