Photo Credit: Simon Cunningham

LendingClub Corp. (LC) Financials – Diversified Financial Services | Reports May 9, After Market Closes

Key Takeaways

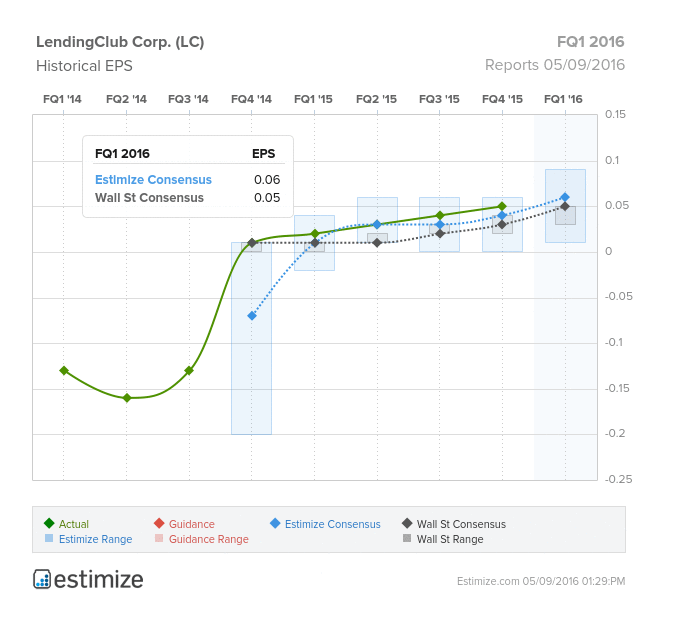

Peer to peer marketplace, Lending Club, is scheduled to report first quarter earnings today, after the market closes. Lending Club has fallen victim to the same problems that many of its peers have experienced in recent years. Steadily increasing income and modest bottom line growth have simply not been enough to appease investors. In the past 6 months shares of Lending Club have dropped over 50% thanks to weak forward guidance. Earnings, however, are still showing signs of topping expectations. The Estimize consensus is calling for earnings of 6 cents per share on $149.95 million in revenue, 1 cent higher than Wall Street on the bottom line and $2 million on the top. Compared to a year earlier profits are forecasted to increase 184% while revenue could increase as much as 85%.

Lately, online lenders are teaming up up with banks to spur origination loans and sell loans to investors. However given the current market volatility, these companies are losing their appeal amongst both borrowers and investors. Unfortunately for Lending Club, success is contingent on its peers. This past week the company saw shares plummet over 10% after OnDeck reported weak earnings and forward guidance. The concern is Lending Club will report the same problems when it discloses earnings today. Apart from systemic concerns, Lending Club is seeing weakness in multiple areas such as its high debt management risk. If Lending Club can’t unload loans to investors, as has been the case, this leaves a large amount of risk still on its books. So while loan originations increased 82% last quarter and continue to increase, Lending Club moves into riskier territory. Just today Lending Club CEO, Renaud Leplanche, resigned after ongoing allegations of sales not meeting investor’s criteria. Shares are now down nearly 25% in pre market trading since the announcement.

Leave A Comment