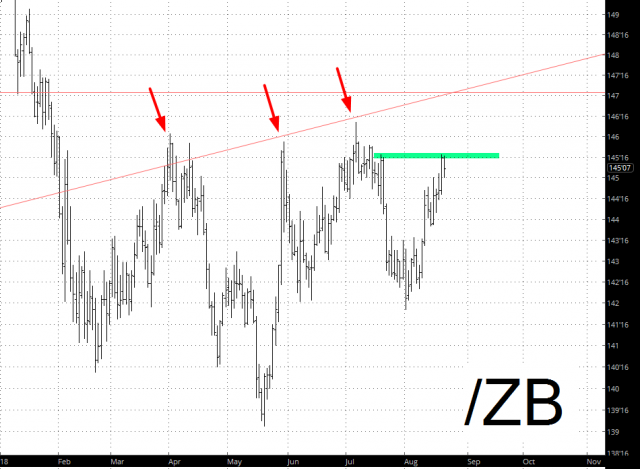

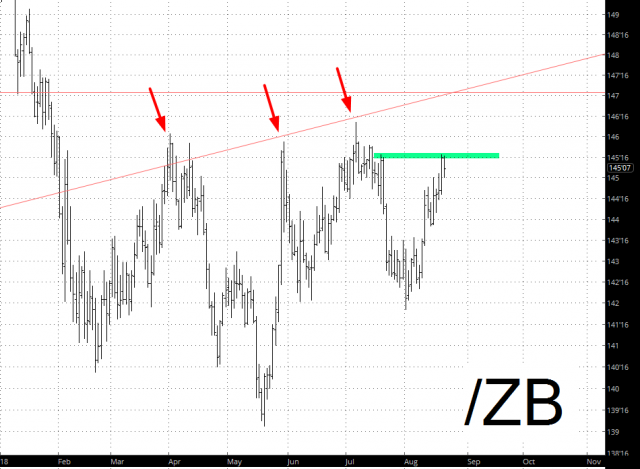

The only red on my screen this morning (and it’s down only the tiniest bit) is bonds. This is a market I watch terribly closely, because as I’ve said through most of 2018, the core shift I’m looking for is an increase in interest rates and an accompanying decrease in real estate valuations. Through the course of the year, the now-broken trendline has done an effective job of repelling prices (arrows). At the moment, my fondest hope is that prices don’t either bother getting back to the trendline and instead turn away from that green tinted area.

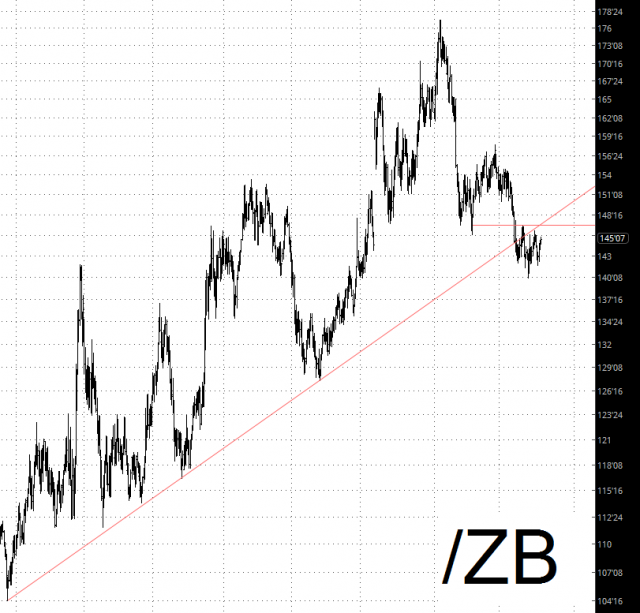

Zoomed in as we are above, it’s not clear how crucial that trendline break was. Taking a multi-decade step back, however, you can plain see how that trendline failure matters quite a bit, and how even the strength we’ve seen for the entirety of August is meaningless, and all price action has been beneath the failure.

Real estate, in turn, has been terribly strong for many weeks now, aided by the relaxation of interest rates. The ETF symbol IYR (real estate), however, has broken its own trendline (circle) and, interestingly, is coming right up against another trendline anchored to the historic high of the housing bubble.

For myself, I am positioned rather mildly, using only about 135% of buying power and, in general, keeping an interesting eye on the market during this potential new breakout phase in equities.

Leave A Comment