Photo Credit: Mike Mozart

Marriott International, Inc. (MAR) Consumer Discretionary – Hotels, Restaurants & Leisure | Reports February 17, After Market Closes

Key Takeaways

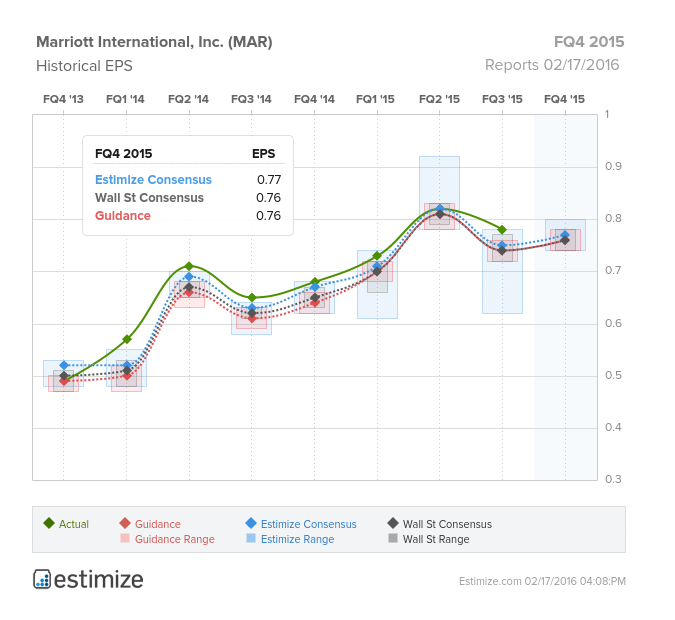

Marriott is scheduled to report fourth quarter earnings February 17, after the market closes. The company is coming off 3 consecutive quarters in which they beat on the bottom line but missed on revenue. Marriott is well positioned for favorable earnings this Thursday as demand increases in business and leisure traveling. The Estimize consensus is calling for EPS of $0.77, 1 cent higher than Wall Street, and revenue expectations of $3.734 billion, $13 million lower than the street. Compared to Q4 2014, this represents a projected YoY increase in EPS and revenue of 13% and 5%, respectively. Marriott has historically beaten on the bottom line, besting the Estimize EPS estimate 79% of the time and Wall Street a resounding 83% of the time. Marriott’s brand advantage has led to demand outpacing supply growth, supporting strong revenue per available room growth (RevPAR).

Marriott’s strong brand recognition has been showcased by its unit room growth, amid weak economic conditions. Even after the Paris attacks and threats of the Zika virus, international travel is primed to deliver strong RevPAR growth. In December 2015, Marriott bolstered its presence in managing properties with the acquisition of Starwood Hotels and Resorts. The merger will create the world’s largest hotel company consisting of over 5,500 properties worldwide. Meanwhile, the company has capitalized on digital initiatives to further validate its brand advantage. Marriott’s strong online presence and extensive loyalty program has driven booking growth, accounting for over 50% of the company’s total rooms booked.

Leave A Comment