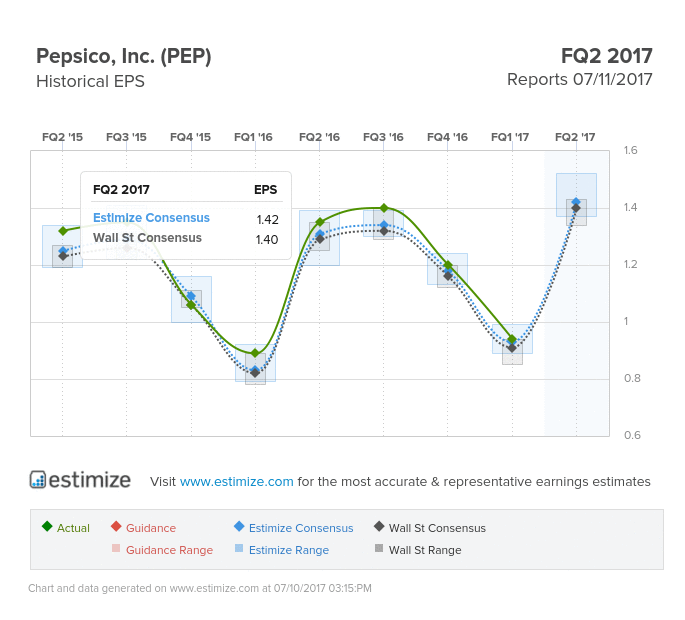

Pepsico, Inc. (PEP) will release FQ2’17 earnings before the market opens on Tuesday, July 11th. Pepsi has been on somewhat of a rollercoaster ride in terms of EPS and revenue, the company’s Q4 and Q1 showed a downward trend, with a bounceback in Q2; which is exactly what Estimize and the Street are predicting for this upcoming report. The Estimize community is predicting EPS to come in two cents higher than the street at $1.42, and revenue at $15.662M, which is slightly more optimistic than the street ($15.642M). Estimize data also highlights that Pepsico sees positive price movement after an earnings release 68% of the time. The Estimize data also shows that Pepsico’s EPS beats the street 93% of the time.

Pepsi is constantly growing their brand. Beyond their namesake brand, they’ve created partnerships and/or acquired a plethora of household names like Cheetos, Lay’s, Tropicana, Starbucks, Quaker Oats, and the list goes on. The extensive list of brands are mitigating the risk associated with weak soda volumes, specifically a 9.2% drop in Diet Pepsi in 2016. Furthermore, Pepsi is creating brands that fit the health conscious market such as the launch of LIFEWTR which is a electrolyte-enhanced water. Analysts at Jefferies have a “Buy” rating and a price target of $130.

Leave A Comment