Photo Credit: Maurizio Pesce

QUALCOMM Inc. (QCOM) Information Technology – Communications Equipment | Reports January 27, After Markets Close

Key Takeaways

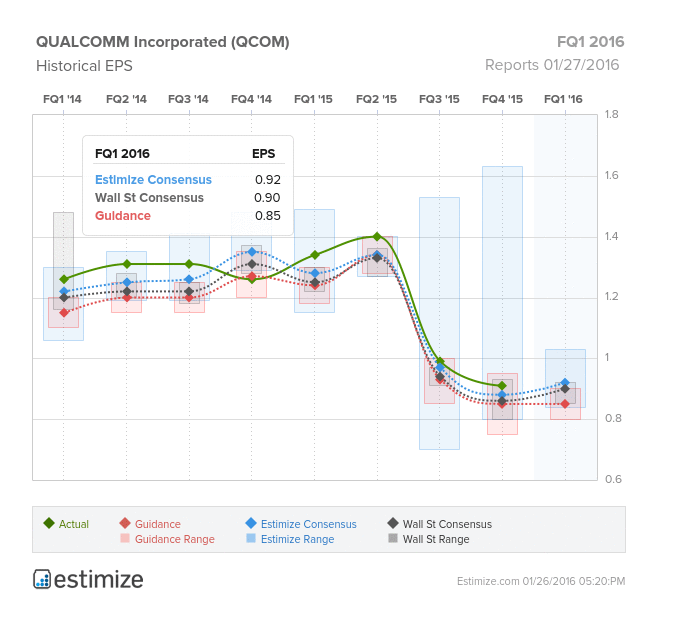

Qualcomm, a world leader in 3G and 4G wireless technology, is scheduled to report fiscal first quarter 2016 earnings January 27th, after the markets close. Without knowing it, most consumers own a product which uses Qualcomm wireless technology, whether it’s a tablet, smartphone or even a car. This past year was not particularly favorable for the chip maker which saw share prices plunge over 30%. Qualcomm fell victim to a $1 billion antitrust fine, losing a key customers and currency headwinds from a strong U.S. dollar which are expected to take its toll on the company’s fiscal first quarter earnings. The Estimize consensus calls for EPS of $0.92 and revenue of $5.699 billion, right in line with Wall Street’s estimates. Compared to FQ1 2015, this represents a projected YoY decline in EPS and revenue of 30% and 19%, respectively. With the worst presumably behind Qualcomm, negative sentiment continues to weigh down investor’s expectations despite the chip maker beating estimates 7 of the last 8 quarters.

Typically, the first fiscal quarter is peak season for Qualcomm, however with a declining semiconductor market muddled with its own controversy, Qualcomm should expect to report modest increases. Despite its recent blunders, Qualcomm’s lead in wireless chip design and revenue generated from patent licensing should help the company bounce back in 2016. After abandoning a key partner, Samsung has decided to resurrect their relationship with Qualcomm and incorporate the chip in its newest Galaxy device. Qualcomm has also claimed a stake in emerging markets, specifically in China. The company intends to design and sell chips in order to compete with Intel’s dominant market position. While mobile chips are Qualcomm’s bread and butter, the chipmaker is looking to diversify into automotives, Internet of Things (IoT), networking and computing. As the mobile markets mature and become saturated, these adjacent markets can help drive revenue growth. While the stock tapered downwards during 2015, Qualcomm has the pieces in place to rebound in 2016.

Leave A Comment