Welcome our loyal readers to the weekly Market Outlook as we usher in the new month of June. This is now the beginning of the summer months and what is typically a much more subdued market environment. More on that later.  depositphotos Hope that this past May was profitable for you in your trading and investment accounts. The month of May continued the bull market trajectory which started back in October 2022 and has now produced positive returns for 4 out of the first 5 months of 2024, a move not seen possible by many of Wall Street’s best and brightest analysts. Recently, many of them have been upping their year-end 2024 stock market price projections.

depositphotos Hope that this past May was profitable for you in your trading and investment accounts. The month of May continued the bull market trajectory which started back in October 2022 and has now produced positive returns for 4 out of the first 5 months of 2024, a move not seen possible by many of Wall Street’s best and brightest analysts. Recently, many of them have been upping their year-end 2024 stock market price projections.  All of this came with enhanced volatility, as we had been suggesting throughout our last 4-6 weeks of Market Outlooks. There are current headwinds, including softening economic numbers and the prospect of no interest rate cuts by the Federal Reserve until later in the year. The betting pool now has the odds of a cut with the highest probability of arriving in November and 2 weeks after the election so as not to influence voting.In fact, if the stock market had closed at 2:00 p.m. on Friday instead of at 4:00 p.m. as regularly scheduled, the returns of the market, especially the S&P 500, may have looked very different for the monthly returns. The SPY was down 0.80% before mid-afternoon for the day Friday and did an about-face reversal and closed positive 0.80%, which was a 160 bp reversal. Had earlier in the day returns stuck, the S&P would have been up 3.46% for the month instead of 5.06%.Big difference. As you will soon see this would have changed some of the positive projections of what happens if the market closes with a 5% or better return for May (instead of 3.4%). See a few charts below illustrating this turnabout late on Friday.

All of this came with enhanced volatility, as we had been suggesting throughout our last 4-6 weeks of Market Outlooks. There are current headwinds, including softening economic numbers and the prospect of no interest rate cuts by the Federal Reserve until later in the year. The betting pool now has the odds of a cut with the highest probability of arriving in November and 2 weeks after the election so as not to influence voting.In fact, if the stock market had closed at 2:00 p.m. on Friday instead of at 4:00 p.m. as regularly scheduled, the returns of the market, especially the S&P 500, may have looked very different for the monthly returns. The SPY was down 0.80% before mid-afternoon for the day Friday and did an about-face reversal and closed positive 0.80%, which was a 160 bp reversal. Had earlier in the day returns stuck, the S&P would have been up 3.46% for the month instead of 5.06%.Big difference. As you will soon see this would have changed some of the positive projections of what happens if the market closes with a 5% or better return for May (instead of 3.4%). See a few charts below illustrating this turnabout late on Friday.

MarketGauge StrategiesSeveral of our investment strategies were up big for the month as our quant algo systematic trading continued to uncover trending opportunities in different stocks, sectors and commodity related instruments. The GEMS strategy (comprised of Sector Moderate and Global Macro) ETF model was up over 9% for the month as semiconductors and Metals and Mining including, gold miners and silver all helped contribute to these returns.Our Large Cap Leaders were up over 6.9% helped by technology (semiconductor) and utility/energy stocks helping pave the way. And then there is our core tactical strategy, Profit Navigator, which had a 7.8% up move for the month in our risk-managed 2x SPY ETF strategy. The Bull continuesWe have repeated numerous times recently that earnings have been the main driver for the solid performance numbers thus far in 2024. This is in the face of persistent inflation, higher interest rates and signs of a slowing economy. This was beginning to show up in some recent earnings misses that took the Dow Jones down 8 of the last 9 days in the market. See charts on the Dow below:

MarketGauge StrategiesSeveral of our investment strategies were up big for the month as our quant algo systematic trading continued to uncover trending opportunities in different stocks, sectors and commodity related instruments. The GEMS strategy (comprised of Sector Moderate and Global Macro) ETF model was up over 9% for the month as semiconductors and Metals and Mining including, gold miners and silver all helped contribute to these returns.Our Large Cap Leaders were up over 6.9% helped by technology (semiconductor) and utility/energy stocks helping pave the way. And then there is our core tactical strategy, Profit Navigator, which had a 7.8% up move for the month in our risk-managed 2x SPY ETF strategy. The Bull continuesWe have repeated numerous times recently that earnings have been the main driver for the solid performance numbers thus far in 2024. This is in the face of persistent inflation, higher interest rates and signs of a slowing economy. This was beginning to show up in some recent earnings misses that took the Dow Jones down 8 of the last 9 days in the market. See charts on the Dow below:  But on Friday, the Dow came back with a vengeance. Is this a preview of something more positive in June? (don’t count on it). See charts below:

But on Friday, the Dow came back with a vengeance. Is this a preview of something more positive in June? (don’t count on it). See charts below: The S&P 500 ended on the highest monthly close EVER. Additionally, a positive sign is that the S&P 500 also ended the month with a BULLISH engulfing candle. See below:

The S&P 500 ended on the highest monthly close EVER. Additionally, a positive sign is that the S&P 500 also ended the month with a BULLISH engulfing candle. See below: It’s all about the earnings.As we mentioned during the past couple of weekly Market Outlooks, the markets have behaved positively on the back of expectation earnings beats. (If you did not yet have a chance to read last week’s Market Outlook, here is the link to go back and review it).The stock market has been enjoying a period of extraordinary success. Investors have been feeling positive, especially as the stock indices make new all-time highs. The Dow recently surpassing the 40,000 milestone only helps fuel confidence.There are several key factors helping to contribute to this market euphoria. Friday’s PCE inflation core number came in down by 0.1% indicating that inflation is moderating. A resilient and strong economy along with impressive corporate profits, have helped create a positive environment for stock investing in the US.Michael Arone, chief investment strategist at State Street Global Advisors highlighted this week the unexpected resilience of the economy as a major diving force. Despite predictions of a recession, the economy has continued to expand, fueled by consumer spending and a robust labor market. Arone further pointed out that while GDP growth has slowed slightly, estimates for the coming quarter remain more promising.This writer remains of the belief that corporate earnings have been the main driver of the Stock Market’s performance as the majority of companies in the Morningstar US Market Index reported positive surprises. However, a recent graph depicts that without the stellar positive earnings of the Magnificent 7, earnings may have been stagnant. See chart below:

It’s all about the earnings.As we mentioned during the past couple of weekly Market Outlooks, the markets have behaved positively on the back of expectation earnings beats. (If you did not yet have a chance to read last week’s Market Outlook, here is the link to go back and review it).The stock market has been enjoying a period of extraordinary success. Investors have been feeling positive, especially as the stock indices make new all-time highs. The Dow recently surpassing the 40,000 milestone only helps fuel confidence.There are several key factors helping to contribute to this market euphoria. Friday’s PCE inflation core number came in down by 0.1% indicating that inflation is moderating. A resilient and strong economy along with impressive corporate profits, have helped create a positive environment for stock investing in the US.Michael Arone, chief investment strategist at State Street Global Advisors highlighted this week the unexpected resilience of the economy as a major diving force. Despite predictions of a recession, the economy has continued to expand, fueled by consumer spending and a robust labor market. Arone further pointed out that while GDP growth has slowed slightly, estimates for the coming quarter remain more promising.This writer remains of the belief that corporate earnings have been the main driver of the Stock Market’s performance as the majority of companies in the Morningstar US Market Index reported positive surprises. However, a recent graph depicts that without the stellar positive earnings of the Magnificent 7, earnings may have been stagnant. See chart below:  Earnings revisions have not existed.Typically, after the first 2 months into a quarter, analysts begin to revise their earnings expectations. Such has not been the case for 2024. This bodes well going forward.

Earnings revisions have not existed.Typically, after the first 2 months into a quarter, analysts begin to revise their earnings expectations. Such has not been the case for 2024. This bodes well going forward. It’s been mostly about Growth.So far in 2024, growth stocks have had a sizable advantage over value stocks. The VUG (Vanguard Growth ETF) is up 12.8% versus the VTV (Vanguard Value ETF) up only 7.8%. However, analysts are beginning to believe that growth stock appreciation could slow and value might catch up, especially with the prospect of the Fed lowering rates sometime later this year. Growth stocks, as evidenced in the below NASDAQ cycle chart, are starting to hit some resistance compared to value stocks.

It’s been mostly about Growth.So far in 2024, growth stocks have had a sizable advantage over value stocks. The VUG (Vanguard Growth ETF) is up 12.8% versus the VTV (Vanguard Value ETF) up only 7.8%. However, analysts are beginning to believe that growth stock appreciation could slow and value might catch up, especially with the prospect of the Fed lowering rates sometime later this year. Growth stocks, as evidenced in the below NASDAQ cycle chart, are starting to hit some resistance compared to value stocks.  Will the bull market continue?

Will the bull market continue? We don’t know, but there is plenty of empirical evidence to suggest that this being an election year, and coupled with the positive economic factors mentioned above, it can continue.Instead of pontificating about why corporate earnings, consumer spending and a tight labor market could all stay robust and provide a tailwind to investors, we offer what has typically happened with a 5% positive May, an election year and other factors that could suggest we will continue to see the bull market prevail. A better than 5% May could keep the bulls smiling. As you are aware, we love the charts and graphs that Ryan Detrick provides for Carson Wealth Management. We appreciate that he produces these. Now that we know the S&P 500 (SPY) performance came in at 5% or greater, this chart has a new meaning. See below:

We don’t know, but there is plenty of empirical evidence to suggest that this being an election year, and coupled with the positive economic factors mentioned above, it can continue.Instead of pontificating about why corporate earnings, consumer spending and a tight labor market could all stay robust and provide a tailwind to investors, we offer what has typically happened with a 5% positive May, an election year and other factors that could suggest we will continue to see the bull market prevail. A better than 5% May could keep the bulls smiling. As you are aware, we love the charts and graphs that Ryan Detrick provides for Carson Wealth Management. We appreciate that he produces these. Now that we know the S&P 500 (SPY) performance came in at 5% or greater, this chart has a new meaning. See below:  Positive expectations for the summer months.All indications are that because this is an election year and we have had a positive market so far after 5 months, we might not see the June swoon that investors might expect. See graph below:

Positive expectations for the summer months.All indications are that because this is an election year and we have had a positive market so far after 5 months, we might not see the June swoon that investors might expect. See graph below:  Here is a close-up to the above chart for election years only:

Here is a close-up to the above chart for election years only: Stocks do even better in the election cycle when it is not a lame duck President:

Stocks do even better in the election cycle when it is not a lame duck President: What might help contribute to a positive market for the remainder of the year BESIDES the election cycle? There is still an abundance of money market funds sitting on the sidelines. See chart below.

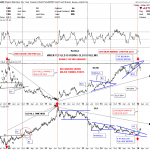

What might help contribute to a positive market for the remainder of the year BESIDES the election cycle? There is still an abundance of money market funds sitting on the sidelines. See chart below. How to know when to take some money off the table?Of course, we are biased in that we have the best tools to evaluate the investing environment including Mish’s Daily, which contains ongoing analysis of the markets daily…you can sign up here. Other tools include the Big View charts (upgraded this week and they are dazzling) along with the risk gauges, which provide a good perspective if it’s desirable to be invested in the markets and of course, Profit Navigator with its dual technical engines has been a reliable determinant of a positive market bias. (hint: it has been invested most of 2024).Another thing you can do, as we discuss frequently and is also presented in BIG VIEW, is watch the trends and map out trendlines that will keep you on the right side of the market. I saw this graph yesterday, which identified some of these trendlines just this week, and thought it may be useful to review, below:

How to know when to take some money off the table?Of course, we are biased in that we have the best tools to evaluate the investing environment including Mish’s Daily, which contains ongoing analysis of the markets daily…you can sign up here. Other tools include the Big View charts (upgraded this week and they are dazzling) along with the risk gauges, which provide a good perspective if it’s desirable to be invested in the markets and of course, Profit Navigator with its dual technical engines has been a reliable determinant of a positive market bias. (hint: it has been invested most of 2024).Another thing you can do, as we discuss frequently and is also presented in BIG VIEW, is watch the trends and map out trendlines that will keep you on the right side of the market. I saw this graph yesterday, which identified some of these trendlines just this week, and thought it may be useful to review, below:  A quick update on housing prices which we discussed last week. There has been a historical pattern in the past few years in housing prices. The graph below is an excellent depiction of what our housing markets look like as compared to the previous few years. Will we see another period of housing price reductions? See below:

A quick update on housing prices which we discussed last week. There has been a historical pattern in the past few years in housing prices. The graph below is an excellent depiction of what our housing markets look like as compared to the previous few years. Will we see another period of housing price reductions? See below:  Enjoy and have a good upcoming week in your investing accounts.

Enjoy and have a good upcoming week in your investing accounts. More By This Author:Where Is The Economy Going? Transports Are Crashing Without Breaking NewsPay No Attention To That Tran Behind The Curtain?

More By This Author:Where Is The Economy Going? Transports Are Crashing Without Breaking NewsPay No Attention To That Tran Behind The Curtain?

Leave A Comment