Photo Credit: Joe Lazarus

Twitter, Inc. (TWTR) Information Technology – Information, Software & Services | Reports February 10, After Market Closes.

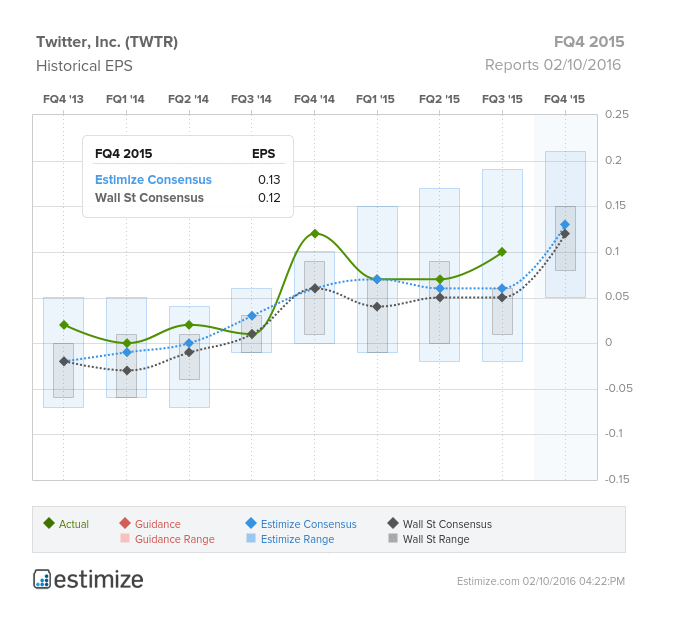

Twitter (TWTR) appears to be a company in search of their identity. Despite coming off two straight quarters of growth, share prices have taken a severe beating. This quarter the Estimize consensus is calling for EPS of $.013, just one penny higher than Wall Street, and revenues of $711.88 million, roughly $2.64M ahead of the Street. Compared to Q4 2014, this represents a projected YoY increase in EPS and revenue of 5% and 48%, respectively. That said, investors and users have lost faith in the long term trajectory the company is pursuing.

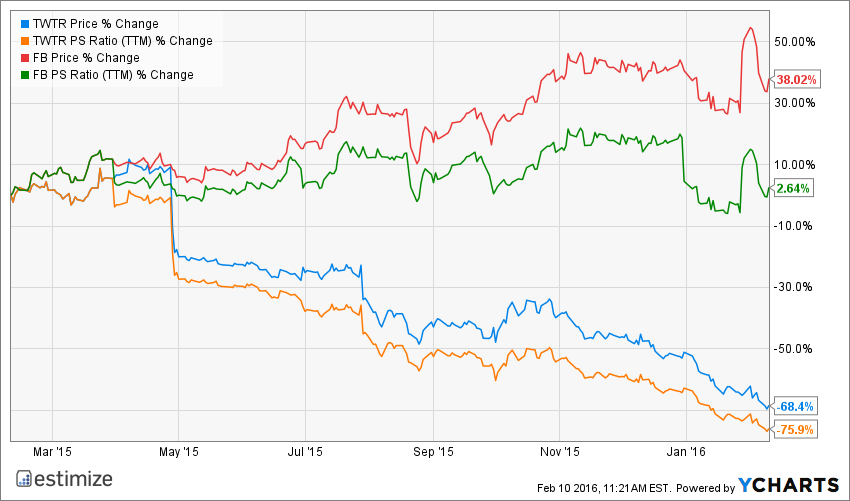

Once hailed for its live action feeds and multiplying user base, the platform has taken a nosedive. Just yesterday, share prices hit a new 52 week low, falling to $14.31 a share. User growth has plateaued, and now there is public outcry over a proposed change to the beloved reverse chronological order timeline Twitter was founded on.

Amid continued struggles, Twitter decided that a change in how users view content was necessary. Taking a page from Facebook’s strategy, Twitter decided to switch its reverse chronological order timeline to an algorithmic one. The algorithmic timeline would sort content based on relevance and interest to the individual. While it makes sense in theory, the outraged Twitter faithful spoke out against the changes, starting the #RIPTwitter movement. Consequently, Dorsey took to Twitter to reassure users that the company is always listening to user feedback, yet still decided to roll out the algorithmic timeline today.

Last quarter, monthly active users grew by mere 4 million, reaching 320 million users. A slowdown in user growth and engagement is a source of concern as advertisements are the company’s primary source of revenues. Twitter’s ability to attract ad revenue amid significant competition, from Google and Facebook, will be key to determining its growth.

Leave A Comment