Guest post by Norman Mogil

What does the oil price collapse mean for Canada? A simple question with an answer that is anything but simple. As the Governor of the Bank of Canada (BoC), stated the “oil price shock is complex because it sets in motion several forces ” that will alter the path of Canada’s economic future. The Governor goes on to argue that “it may take up to three years for the full economic impact to be felt, and even longer for all of the structural adjustments to take place.” Just what are the structural and time factors that we need to understand as we adjust to the new environment of lower commodity prices?

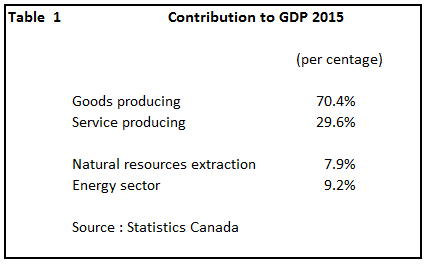

We start out by considering the structure of the Canadian economy. This will help identify how the various sectors of the economy will be impacted in the future. Broadly speaking, Canada is a service-based economy (70% of output) and only selectively a goods-producing country (30%). The largest component of services is the finance, insurance and real estate (FIRE) which now comprises about 20% of national income. These industries surpass the contribution of mining, oil/gas and energy distribution (17%) and manufacturing (10%). The strength of the services sector blunts much of the pain of falling oil prices.

Immediate Impacts of the Oil Price Collapse

Taking a snapshot of what has happened in the past 12 months, we note in Table 2 that:

Leave A Comment