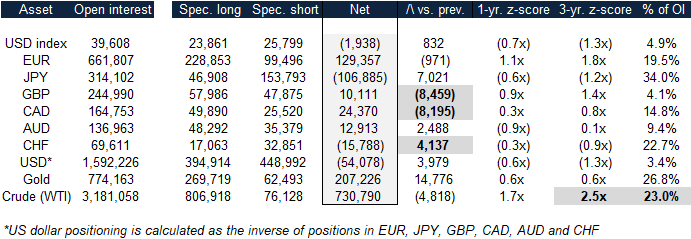

Looking at last week’s Commitment of Traders report, the only notable changes were relating to net positions in the Swiss franc, Canadian dollar and British pound. Changes in positioning were fairly limited for the US dollar, euro, gold and crude oil. Crude oil positions, based on 3-year trailing averages and net speculator positions as a proportion of total open interest, remains at a bullish extreme.

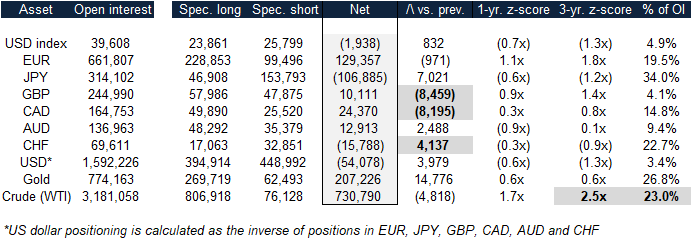

The purpose of this weekly report is to track how the consensus is positioned across various currencies and commodities. When net long positions become crowded in either direction, we flag extended positioning as a risk. Crowded positions do not suggest an imminent reversal, but should be considered as a significant risk factor when investing in the same direction as the crowd. This is shown below:

CFTC COT speculator positions (futures & options combined) – February 20, 2018

Source: CFTC, MarketsNow

Notable extremes, significant changes in weekly positions, and large net positions as a proportion of open interest are highlighted above. Extremes in net positions are highlighted when speculator positioning is more than two standard deviations above trailing 1-year and 3-year averages. Weekly changes are highlighted when they are significant as a proportion of open interest. Finally, net positions as a proportion of outstanding interest are highlighted when they are large relative to historical averages.

The biggest changes this week include falling net positions in the Canadian dollar and the British pound, and rising net positions in the Swiss franc. Canadian dollar net positions are falling as the country grapples with tough NAFTA negotiations and issues with crude oil infrastructure. Recent problems with the Keystone pipeline have resulted in sharply lower prices for Western Canadian Select relative to West Texas Intermediate (the US benchmark price for crude oil). British pound net positions are falling as traders re-assess the likelihood of a Brexit trade deal. Finally, traders are trimming their short positions in the Swiss franc as the currency makes gains against the US dollar and the euro.

Leave A Comment