Talking Points:

The Australian Dollar underperformed in Asia Pacific trade, falling against all of its top currency counterparts. A singular catalyst for the shift was not readily apparent, hinting it may have been corrective after recent gains. CFTC data showing speculative futures positioning at its most net-short in 11 months may have offered some encouragement.

Meanwhile, the Canadian Dollar continued to build higher in the wake of an impressive December jobs report that unexpectedly put the unemployment at 5.7 percent, the lowest in over 40 years. That pushed BOC rate hike bets sharply higher, with the priced-in probability of a January increase risingto 82.5 percent from just 45.2 percent in the prior week.

Looking ahead, a lull in top-tier European and US economic data may put Fed-speak in the spotlight. Comments from presidents of the central bank’s Atlanta, Boston and San Francisco branches are on tap. The markets’ expected 2018 tightening path trails officials’ projections by about one hike, leaving room for upbeat remarks offer a bit of support to the US Dollar.

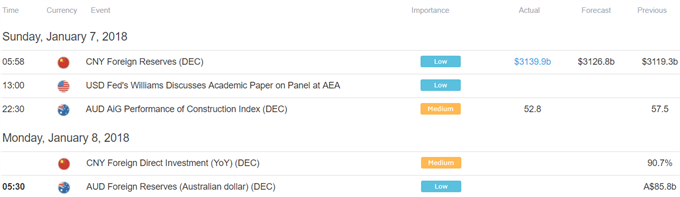

Asia Session

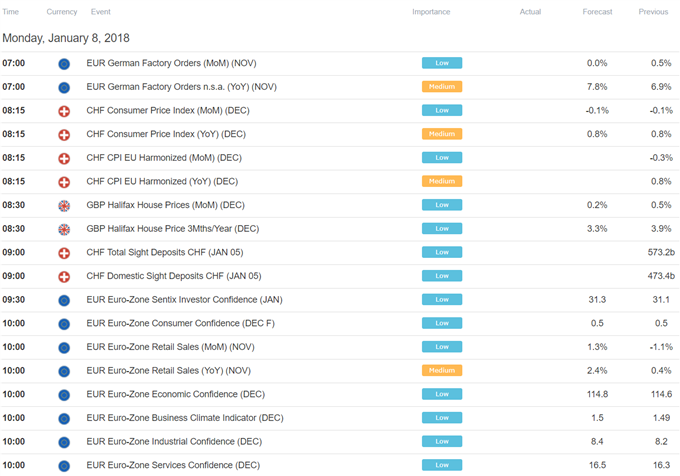

European Session

** All times listed in GMT. .

Leave A Comment