In last-minute late-night talks, Canada and the United States reached an agreement on a new version of the North American Free Trade Agreement. It received a new name: the United States Mexico Canada Agreement (USMCA). Canada agreed to make concessions on opening its dairy market to American farmers while insisting on maintaining the arbitration mechanism, Clause 19. In side letters, the US committed not to slap tariffs on Canada. The northern nation was flabbergasted by the American use of security reasons to impose tariffs on steel and aluminum.

US President Donald Trump and Canadian PM Justin Trudeau hailed the agreement which still needs to be ratified by the legislatures in both countries. Nevertheless, the currency reaction was swift.

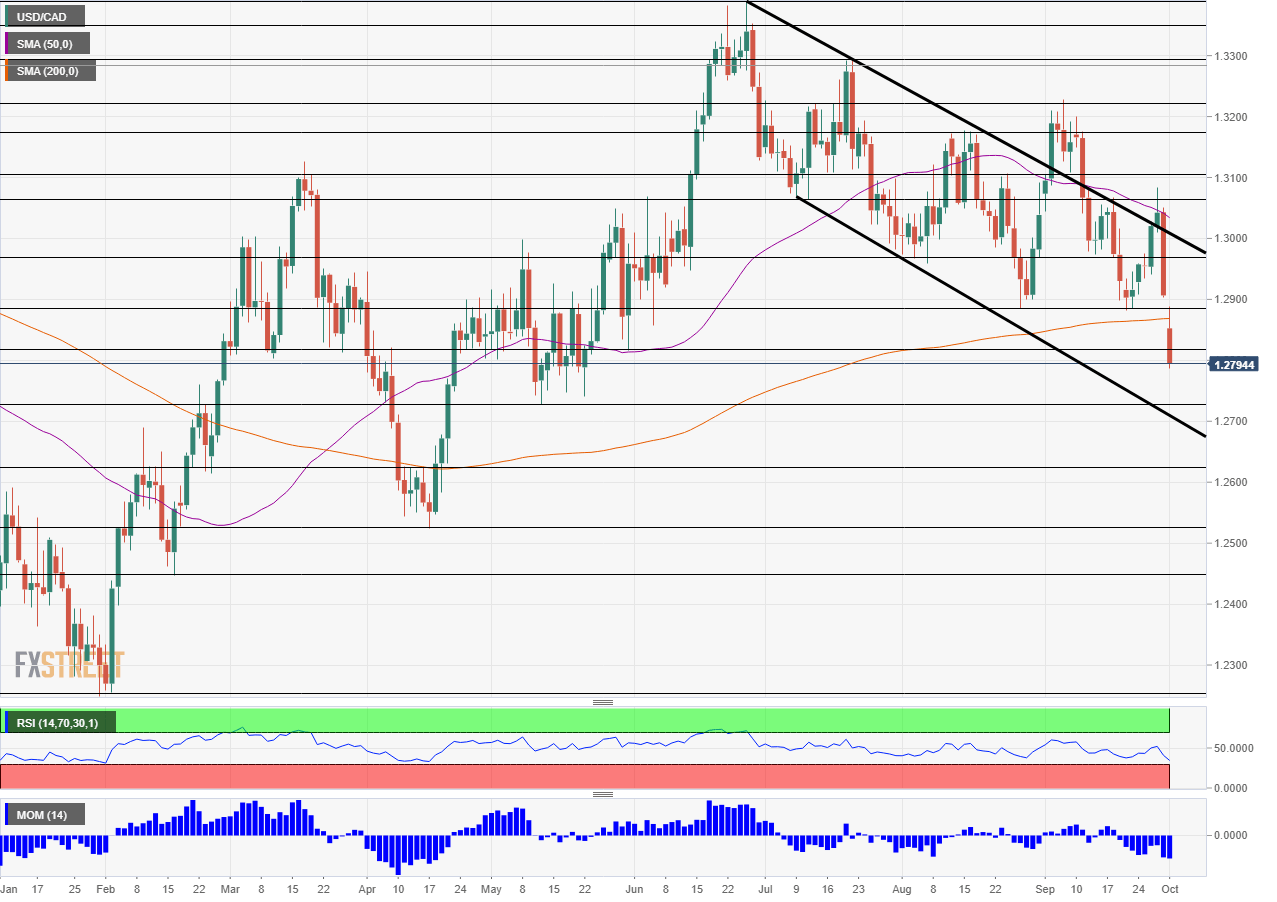

The USD/CAD kicked off the week with a significant Sunday gap and dropped below 1.2800, trading at the lowest levels since May, a four-month low. The Mexican Peso rallied as well.

What level should we watch out for?

USD/CAD Technical Analysis

The USD/CAD dropped below the 200-day Simple Moving Average, a meaningful bearish sign. In addition, Momentum is clearly to the downside. At the time of writing, the Relative Strength Index is above 30, thus not representing oversold conditions. All in all, there is room for more drops.

1.2730 is the next level to watch. The pair was supported at or just above these levels throughout the May, thus making it a significant line of support. Further down, 1.2625 capped the pair when it traded on the low ground back in April and when the SMA200 converged with the price.

Lower, 1.250 served as support back in February. Much lower, 1.2250 was the low point in late January and early February.

Looking up, the previous double-bottom of 1.2880 now turns into resistance. It supported the USD/CAD in September and in August. 1.2970 was a support line back in August and now serves as resistance. Above 1.3000, we find 1.3065 as a stubborn level of resistance. The round number of 1.3100 is next.

Leave A Comment