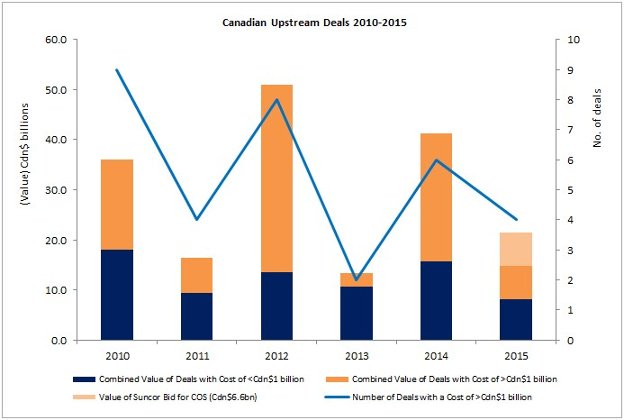

M&A in the upstream sector of the Canadian oil and gas industry saw a very significant drop off from 2014, according to new analysis from CanOils. In 2015, the total combined value for all deals in Canada reached just over Cdn$21 billion, almost half of the 2014 total of Cdn$41 billion. The collapse in oil price has clearly been a major contributing factor to this. 2015 has been a year that has seen cash-rich companies attempt to buy assets at opportunistic price levels from struggling companies, while the potential targets in these deals are reluctant to sell assets at these new lower prices. This dynamic has created an impasse in many cases between buyers and sellers, hence the fall in M&A activity.

Source: CanOils (see notes 1 and 2)

While the 2015 total is not the lowest overall total in recent years, the Cdn$21 billion is bolstered heavily by deals costing over Cdn$1 billion. There were four such deals in Canada in 2015 and together they made up 62% of the Cdn$21 billion total. In fact, the biggest deal of the year, the Cdn$6.6 billion offer made by Suncor Energy (SU) for its Syncrude partner Canadian Oil Sands Ltd. (COSWF), made up around 31% of the Cdn$21 billion total by itself.

If deals or offers with prices of over Cdn$1 billion are excluded from the chart above and deals with values of under this amount are considered independently, then 2015 did see the lowest activity in the last six years. This is similar to the U.S. shale industry, which saw a six-year low in total deal value in 2015 and only one deal with a value over US$1 billion.

Royalty Assets in Vogue

While there was a clear fall in activity in Canadian upstream M&A from 2014 to 2015, there is one asset type that has actually become relatively hot property. Royalty assets have been changing hands frequently and often for large sums since September 2014, when the price collapse began, particularly when compared to similar activity in the 4-5 year period prior to this.

Leave A Comment