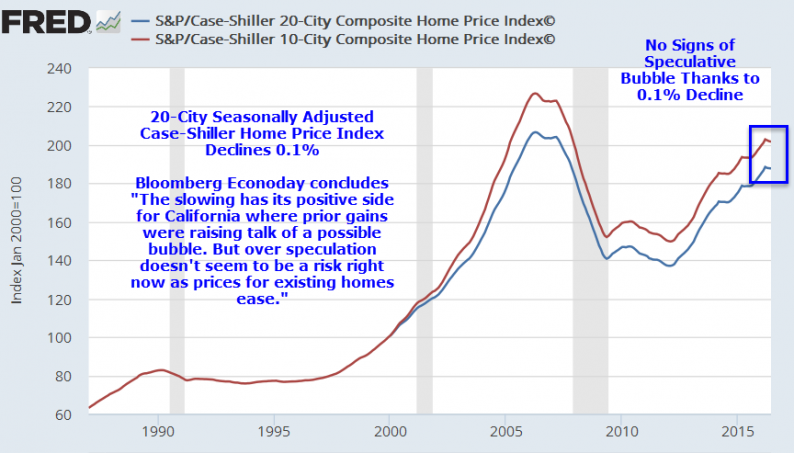

On the basis of a measly 0.1% decline in the Case-Shiller 20-City Home Price Index, Bloomberg Econoday concludes speculation isn’t a risk.

Why do I read keep reading Econoday? Entertainment value.

Highlights

Add Case-Shiller to the list of home-price data that are slipping. The 20-city adjusted index fell 0.1 percent in data for June for the third straight negative score. Year-on-year appreciation also continues to slip, down 2 tenths to 5.1 percent for the slowest rate since August last year. This rate peaked in January at 5.7 percent and, though still respectable, has been sliding since.

Nine of the 20 cities show declines in the latest month with weakness centered in the Midwest and Northeast where Chicago is down on the month and up only 3.3 percent year-on-year with New York also down on the month and up only 2.1 percent on the year. Portland, at 12.6 percent on the year, and Seattle at 11.0 percent are stretching their lead over others in the West with California cities slowing to the mid-single digits.

The slowing has its positive side for California where prior gains were raising talk of a possible bubble. But over speculation doesn’t seem to be a risk right now as prices for existing homes ease.

Case-Shiller City Indexes

Case-Shiller 20-City Price Changes

I’m sure glad to discover there’s no speculation and no bubble in California.

Leave A Comment