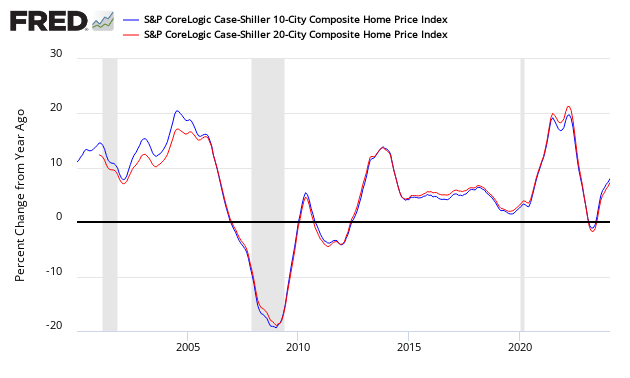

The non-seasonally adjusted Case-Shiller home price index (20 cities) year-over-year rate of home price growth slowed from 5.3 % to 5.1 %. However, the index authors stated “home prices have risen at a consistent 4.8% annual pace over the last two years without showing any signs of slowing”.

Analyst Opinion of Case-Shiller HPI

Recently, there has been an almost insignificant slowing of the Case Shiller HPI year-over-year growth. Many pundits believe home prices are back in a bubble. Maybe, but the falling inventory of homes for sale keeps home prices relatively high. I see this a situation of supply and demand.

S&P/Case-Shiller Home Price Indices Year-over-Year Change

Comparing all the home price indices, it needs to be understood each of the indices uses a unique methodology in compiling their index – and no index is perfect.

Comparison of Home Price Indices – Case-Shiller 3 Month Average (blue line, left axis), CoreLogic (green line, left axis) and National Association of Realtors 3 Month Average (red line, right axis)

z existing3.PNG

The way to understand the dynamics of home prices is to watch the direction of the rate of change. Here home price growth generally appears to be stabilize (rate of growth not rising or falling).

Year-over-Year Price Change Home Price Indices – Case-Shiller 3 Month Average (blue bar), CoreLogic (yellow bar) and National Association of Realtors 3 Month Average (red bar)

Leave A Comment