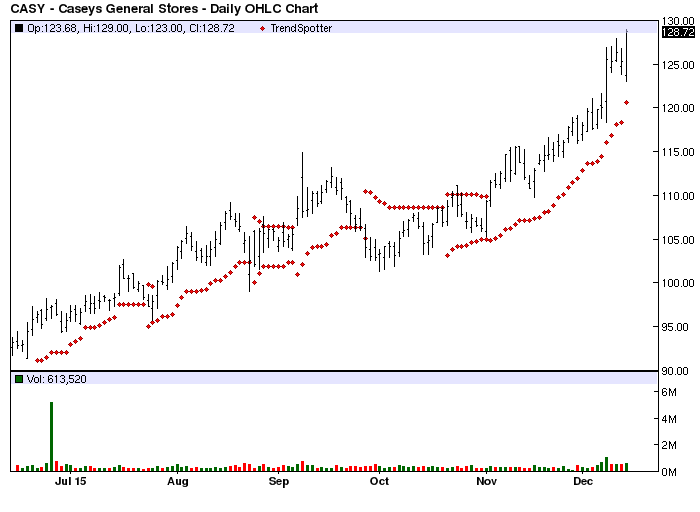

The Chart of the Day belongs to Caseys General Stores (NASDAQ: CASY).. I found the retail convenience store stock by using Barchart to sort the Russell 3000 Index stocks first for the highest number of new highs in the last month, then again for technical buy signals of 80% or better. I then use the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 10/21 the stock gained 18.32%.

Casey’s General Stores, Inc. operate convenience stores under the name “Casey’s General Store“ in Midwestern states, primarily Iowa, Missouri and Illinois. The stores carry a broad selection of food (including freshly prepared foods such as pizza, donuts and sandwiches), beverages, tobacco products, health and beauty aids, automotive products and other non-food items. In addition, all stores offer gasoline for sale on a self-service basis.

The status of Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

Fundamental factors:

Leave A Comment