This has been a very tense week. The persistent tug-of-war between good (the bears) and evil (the bulls) has been worse than ever, with neither side gaining a toehold. Today (Wednesday), however, helped the bearish cause in a couple of ways.

First off, the all-important crude oil bounced perfectly off the upper trendline of its wedge pattern. This is the only reason I made a decent profit today, because my positions are so prone to movement in crude oil. The weaker this gets, the better things go for the bears. Oil is crucial.

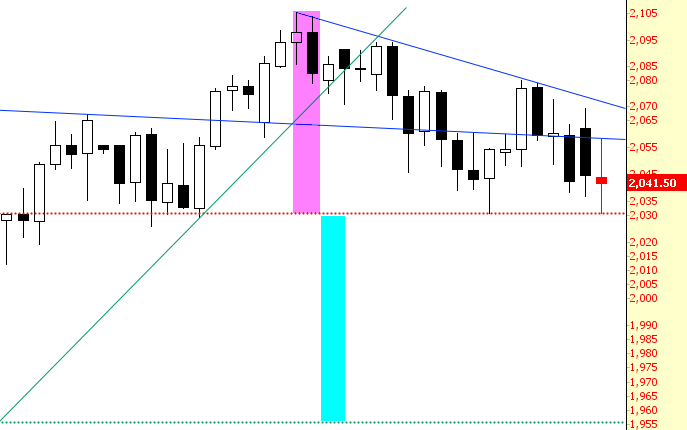

In addition, with the Fed signaling another interest rate increase in just a month from now, the ES has a real chance to break below 2030.50. I have offered a target move below, which I considered only giving to my beloved Slope Plus members, but I figured I’d give the unwashed masses something of value better than a George Carlin clip off YouTube for a change.

I have 73 short positions, the largest of which is JNK. The battle continues on, but if we can break 2030.50, the butter gets spread on the linoleum.

Leave A Comment